You might have heard of an advanced tax-planning strategy called a backdoor Roth conversion, as well as the pro-rata rule that applies to it. But what do those terms really mean, and how do they relate to 401(k) rollovers? Read on for all the details!

What is a backdoor Roth Conversion?

A backdoor Roth conversion is a strategy used by those who make too much money to contribute directly to a Roth IRA (you can see if this applies to you here). Instead, they can make a lump sum contribution of post-tax dollars to a traditional IRA (a non-deductible contribution). Then, by immediately moving the cash into a Roth IRA (without investing it), they’ll have successfully (and legally) circumvented the income limits for direct Roth IRA contributions.

Note that this strategy requires some additional tax reporting. You’ll receive a 1099-R come tax time the following year that will show the movement of money from your traditional IRA to your Roth IRA. Fortunately, this isn’t a taxable distribution if you follow the pro-rata rule.

What is the Pro-Rata rule?

The pro-rata rule focuses on the ratio of non-deductible IRA contributions to the total value of your pre-tax IRAs, taken together. For the simplest outcome, you’d have only one traditional IRA with all non-deductible contributions, meaning any amounts converted to Roth would be considered non-taxable. The reality can be a bit more complicated for some people.

Let’s put some numbers to this and walk through an example – keep in mind that you should replace these example numbers with your own details!

For example, imagine you had $93,500 of pre-tax funds in your traditional IRA. Then, you decide to contribute $6,500 (the 2023 contribution limit for people under the age of 50) of after-tax dollars to this traditional IRA with the intent to do a backdoor Roth conversion of the $6,500 after-tax dollars only.

The issue is that you’re not actually able to designate only the after-tax portion for your Roth conversion; the funds that are converted will do so on a pro-rata basis. Therefore, you’ll need to take into account your total IRA value to find the portion of your conversion that’s non-taxable.

Consider the following calculation:

Therefore, in this example scenario, we’d calculate $6,500 / $100,000 to find that only 6.5% of this backdoor Roth conversion would be non-taxable!

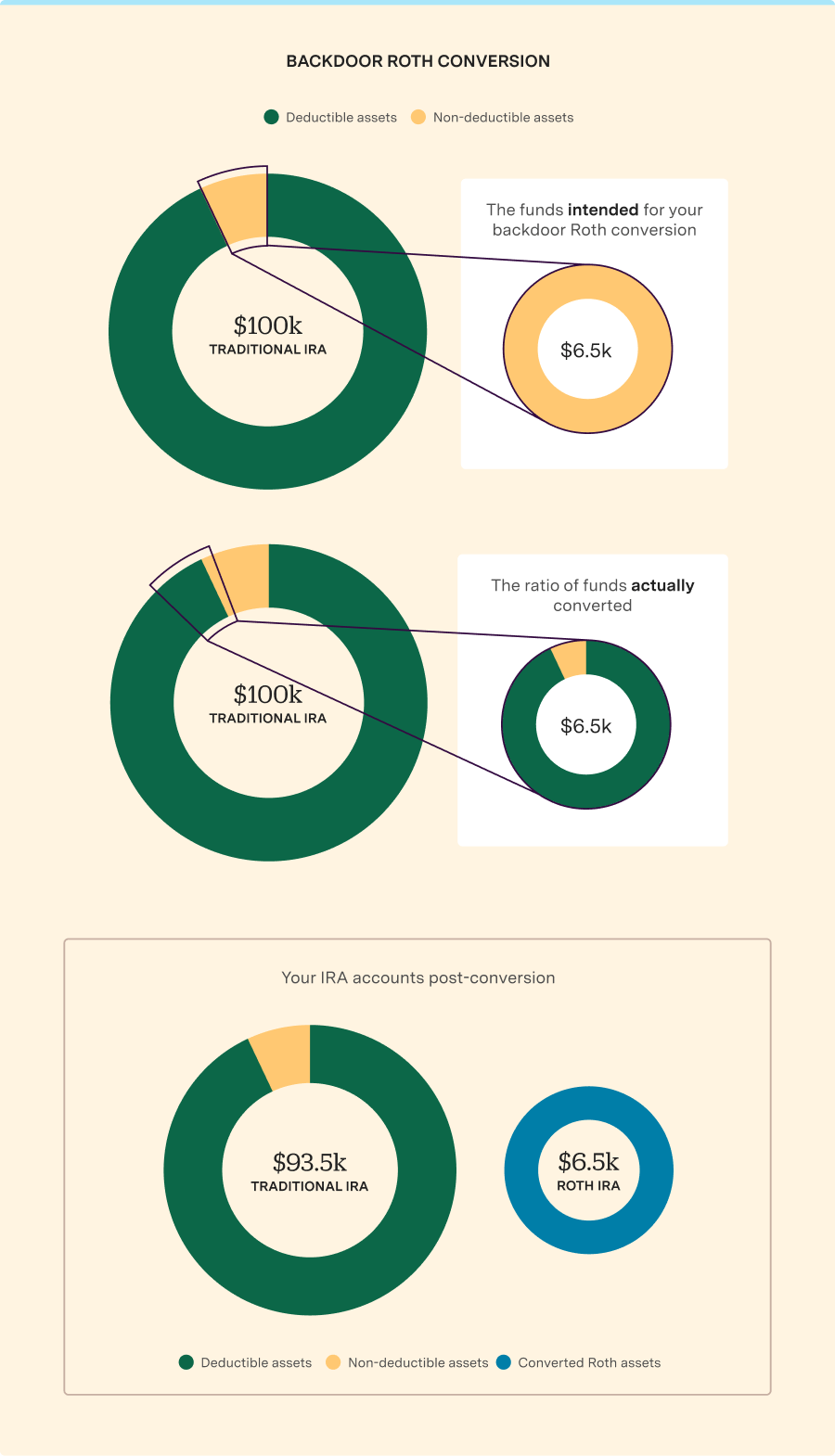

The image below should help visualize this scenario.

We first depict the split of the deductible and non-deductible assets you now have in your traditional IRA, as well as the composition of the piece you’d intended to transfer through a backdoor Roth conversion (i.e. only non-deductible assets).

However, you’ll see that the ratio of funds that are actually converted will match the ratio of funds in your account. Under the pro-rata rule, you can see that 93.5% of your backdoor Roth conversion will actually be taxable to you.

Lastly, take a look at your accounts post-conversion. You’ll have $6,500 in your Roth IRA and $93,500 in your traditional IRA. However, it’s important to note that you’ll leave after-tax funds in your traditional IRA, complicating your next backdoor Roth conversion further.

Note that these calculations happen across all of your traditional IRAs. In other words, it doesn’t matter if you have multiple accounts. You should also keep in mind that the account values for the pro-rata calculations are captured on December 31st of the year the conversion was made; your balances on the date of the actual Roth conversion won’t be relevant for pro-rata rule purposes.

Where do 401(k) rollovers come into play?

If you’re rolling a traditional 401(k) into a traditional IRA, you will be increasing your total base of pre-tax assets subject to the pro-rata rule. A Roth 401(k)-to-Roth IRA rollover won’t impact your pro-rata rule calculations because your assets have already been taxed.

How do I avoid being subject to the Pro-Rata Rule?

Make sure you don’t have any pre-tax funds in your traditional IRAs on December 31st of the year in which you perform a backdoor Roth conversion. There are a few ways to achieve this:

- If you’ve previously rolled traditional 401(k) assets into a Rollover IRA, you can explore rolling these assets into your current company’s 401(k), if your company’s plan allows it.

- If you have pre-tax traditional IRA assets, you could consider converting them into a Roth IRA. While this would be taxed as income, it would allow you to do backdoor Roth conversions with no tax consequences going forward. If you expect to have a lower- income year in the future (perhaps you’re going to graduate school), you can target this year (or years) for deliberate Roth conversion(s).

- Looking forward, you could consider making contributions to a Roth 401(k) instead of a traditional 401(k). That way, if you are ever looking to roll over your 401(k) in the future, your 401(k) assets won’t be subject to the pro-rata rule.