View the latest: See our updated 2023 research here!

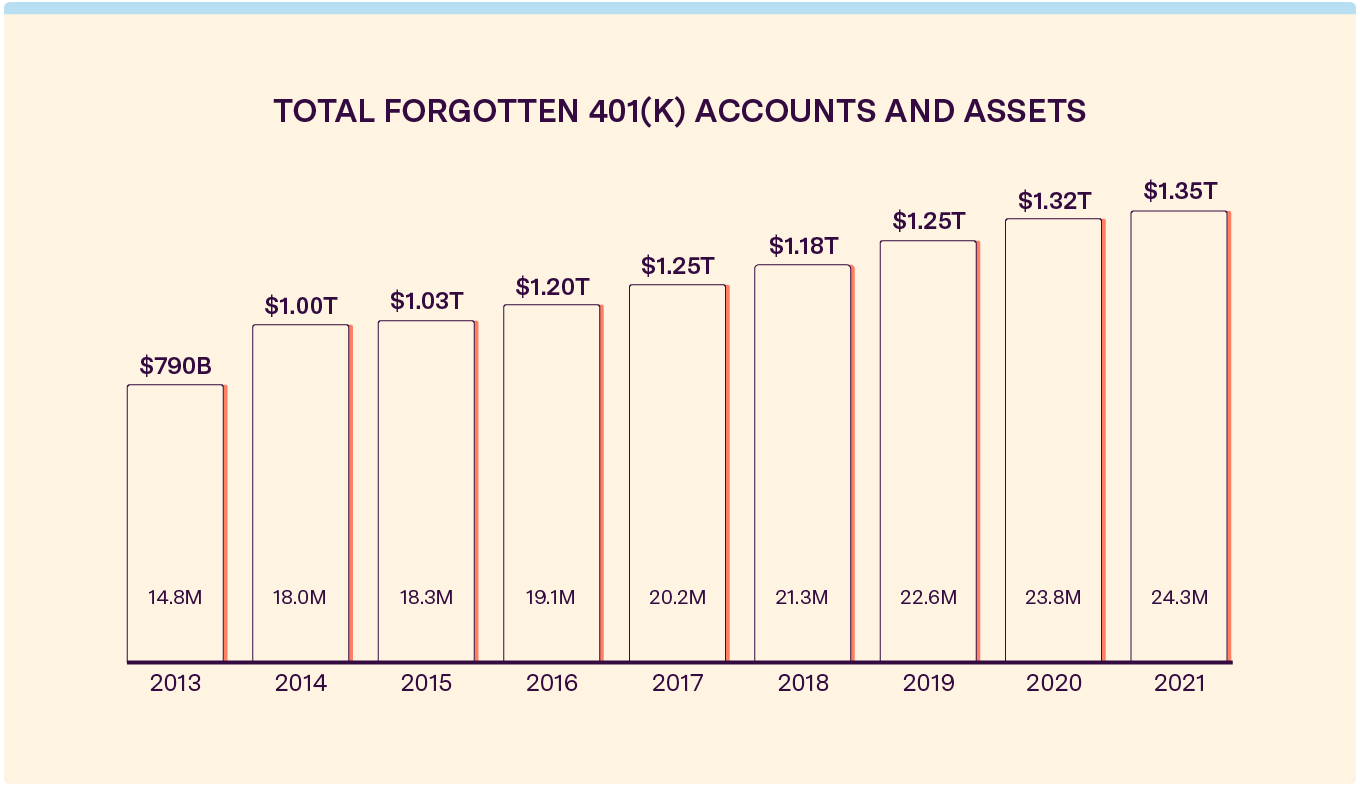

Our new white paper reveals an estimated 24.3 million 401(k) accounts and $1.35 trillion in assets have been left behind by job changers.

If you’ve had multiple jobs in your career, you may have left behind a 401(k) when you changed employers. You’re not alone — it probably won’t surprise you to learn that there are a large number of ‘forgotten’ or ‘left-behind 401(k) accounts in the retirement savings system. These ‘forgotten accounts’ represent 401(k) savings that we’ve left behind in a former employer’s 401(k) plan when we leave that job.

But just how many of these forgotten 401(k) accounts are there? And how much money is in them? Despite plenty of anecdotal evidence that people regularly leave behind 401(k) accounts and increased legislative attention on the problem, surprisingly little work has been done to this point to rigorously estimate the magnitude of this phenomenon.

In an effort to shed light on the problem, Capitalize analyzed a range of data sources over several months and consulted with leading retirement policy experts, including the Center for Retirement Research. Our new analysis illustrates just how large the “forgotten 401(k) problem” really is and what it costs us — both as individual savers and in aggregate.

401(k)s are one of the most popular retirement savings vehicles for Americans. By the end of 2020, Americans had accumulated over $6.7 trillion in 401(k) accounts. These accounts are “employer-sponsored,” which means they’re provided by and linked to our employers — much like healthcare benefits. While 401(k) accounts are great tools for saving money in a tax-efficient way, there’s one major problem: we tend to change jobs every few years and need to decide what to do with the 401(k) savings we’ve accumulated.

We generally have a few options for those savings when we change jobs:

Job transitions are busy times for all of us, so it’s not surprising that many of us choose the path of least resistance and leave our 401(k) account behind for some extended period of time. The result is that we can accumulate multiple 401(k) accounts as we move throughout our careers — and may end up with more than a dozen of them at the end of our working lives.

So how many accounts have been left behind, and how much money is in them?

In our latest white paper on The True Cost of Forgotten 401(k) Accounts (2021), we estimate that there are 24.3 million forgotten 401(k)s holding $1.35 trillion in assets, as of May 2021. Importantly, an additional 2.8 million accounts are left-behind by job changers each year, though some will eventually be reclaimed or liquidated.

We’ve made it our mission to help former employees find your old 401(k) and roll it over into an IRA of your choice — and it’s free!