Our mission: helping people save for retirement

If you’ve ever saved for retirement, chances are you’ve done so in an employer-sponsored account like a 401(k). Much like healthcare, we’ve come to expect that our employers will offer us a retirement account and nudge us to save & invest appropriately.

But what happens when we change jobs, as we do every few years? What do we do with the money we’ve saved?

A $100 billion problem

Unfortunately, we tend to do the wrong thing. Of the more than 15 million people who change jobs with a 401(k) each year, almost 5 million will prematurely “cash out” their account, withdrawing up to $100 billion in the process and paying billions in avoidable taxes and penalties. Once withdrawn, this money no longer grows to provide much-needed financial support during retirement.

Millions more leave their accounts behind for an extended period of time. Based on GAO data, there now may be almost 30 million “orphaned” 401(k) accounts — retirement savings tied to former employers that we’ve forgotten about or have delayed reclaiming. We quickly lose track of what these accounts are invested in and what fees we’re paying as we move throughout our careers.

Put bluntly, much of the good work we do saving in a 401(k) account gets undone when we change jobs. Why?

A broken rollover process

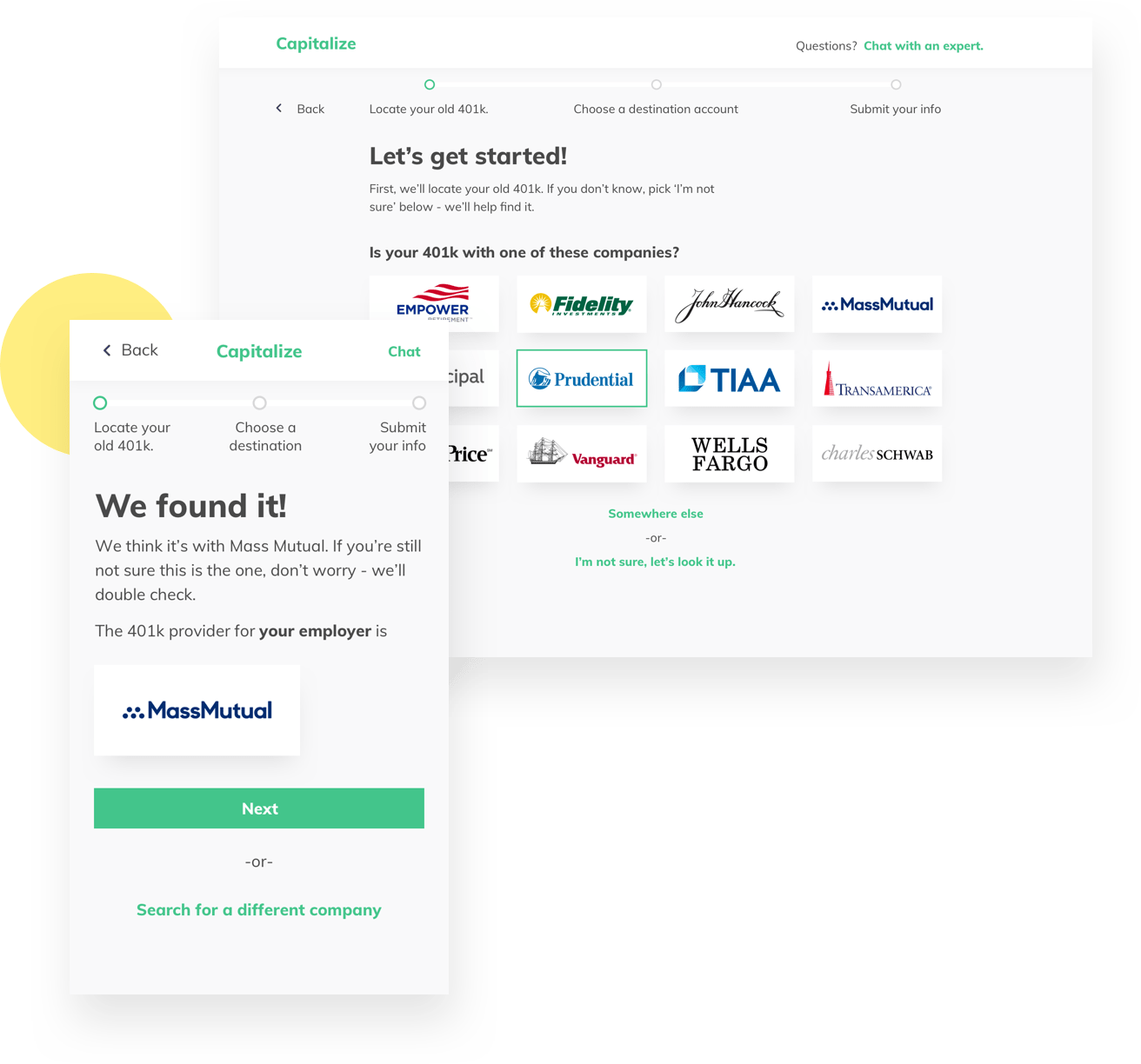

At Capitalize, we believe the culprit is a manual, outdated “rollover” process. If you’re not familiar with a rollover, it’s the industry term for transferring assets from one retirement account to another.

If you are familiar with the rollover process, either through personal experience or hearsay, we suspect you’ll have unpleasant things to say about it. We’ve collected hundreds of comments like the one below describing frustration with a process that frequently involves paper forms, faxes, phone calls, checks in the mail and, believe it or not, notaries.