Year-end 2023

% of US Workers With Access to a 401(k)

Year-end 2023

Number of US Workers With Access to a 401(k)

% Gain in 2023

% Change in Number of Workers With Access

Gain in 2023

Gain in Number of Workers With Access

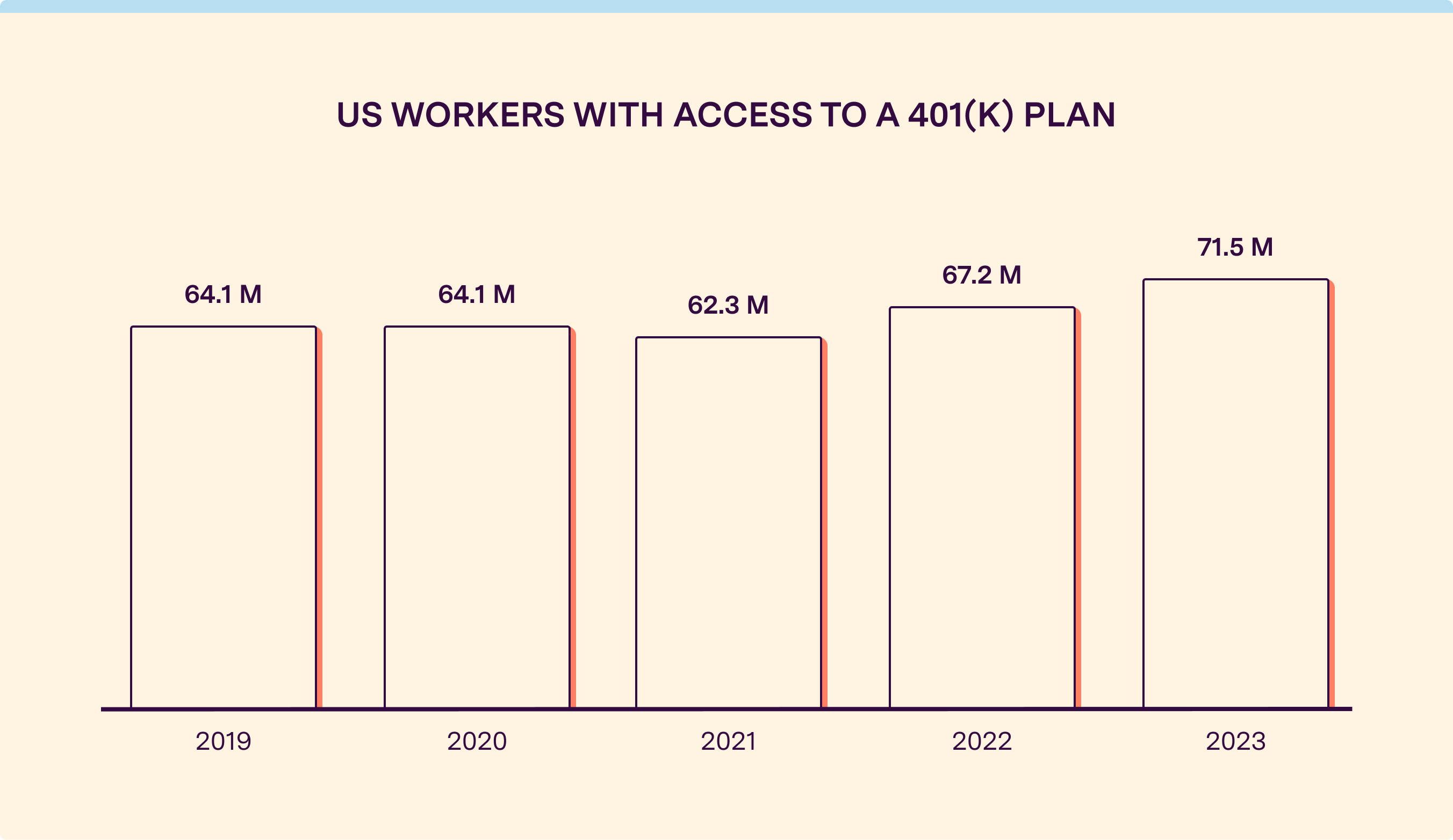

2023 represented the second year in a row of growth in the number of US employees with access to 401(k) plans. The 6.4% growth was a consolidation of the 7.8% gains in 2022, and the number of workers with access has grown in four out of the last five years.

This growth pushed the number of workers with access to 401(k) accounts to cross the 70 million threshold for the first time. The year ended with 71.5 million workers having access to 401(k) plans, compared to 67.2 million in 2022, and 62.3 million in 2021.

What accounts for this acceleration in growth? The SECURE Act of 2019 and the ensuing SECURE Act 2.0 at the end of 2022 provide incentives in the form of tax breaks to employers who offer retirement plans to their employees. They also contain sections that gradually reduce the tenure and number of hours part-time employees must work in order to gain eligibility to these plans. The acronym, SECURE, stands for “Setting Every Community up for Retirement Enhancement.” A second likely factor is an improving macroeconomic environment, as workers who joined more established companies or those with an improved outlook were offered access to retirement plans.

401(k) plans are a subset of the broader category of defined contribution retirement plans, including 401(k), 403(b), and 457-type plans. Unlike traditional pension plans that guarantee a certain level of benefits post-retirement, these are designed to accumulate savings based on worker and employer contributions. 401(k) plans are the leading choice among defined contribution plans. For example, in 2021, 84% of participants in defined contribution plans in 2021 were in 401(k)s, according to Department of Labor data. 401(k) plans can also be rolled over to IRA accounts when employees change jobs.

These numbers in this report reflect private sector workers, and exclude all workers in government (public sector) jobs. For these, defined benefit plans remain common.

The proportion of US workers with access to defined contribution plans has grown steadily over the years, and 401(k) availability has largely driven that broader story. In 2023, 67% of all US employees, 84.6 million total, had access to defined contribution plans. Of these, an estimated 84.5% or 71.5 million had access to 401(k) plans.

This growing prevalence of 401(k) access comes after a few years of relative stasis in the proportion of US workers with access to 401(k) plans. In the three years straddling the pandemic year of 2020, growth in access to 401(k) programs was relatively flat. In 2019, 53.2% of US workers had access to 401(k) programs, but that number barely budged in 2020, reaching 53.4% at the end of that year, and then growing modestly to 54.4% in 2021. Significant growth resumed in 2022, as we have seen, and by the end of that year 55.5% of workers had access to 401(k) plans.

There are a few factors that explain the rapidly growing proportion of workers with access to these plans in the latter two years. One is companies getting ahead of US policy like the aforementioned SECURE Act laws that are encouraging employers to offer 401(k) access. But also involved were disruptions in the labor market and economy during the pandemic, which meant that there was room for faster growth in retirement-plan take-up once workers were reabsorbed into the workforce in 2022 and 2023.

While tax breaks and provisions under SECURE Act could begin to change the calculus, small businesses are the exception to the otherwise broad availability of 401(k) programs at US companies.

In the Fidelity study cited above, only 34% of businesses with less than 100 employees offered retirement plans. Of those, 48% said they did not do so because “they can’t afford one,” 22% said “they’re too busy running their company” to start one, and 21% said they were unsure on how to get such a program started.

Analyzing this data, it appears the barriers to 401(k) adoption are directly addressable. Better education and marketing of these plans would take care of the 21% who simply don’t know how to get started, and better products and technology could help close the gap with the business owners who say they are too busy. Meanwhile, pricing and government policy could be effective in addressing the affordability issue.

Let’s look back at the 2023 SHRM study of 4,217 of its US members, which is cited above. It found that the overwhelming majority, i.e., 94% of the employers represented, offered defined contribution programs. This study was not restricted to large businesses. The survey respondents included HR professionals working at businesses with anywhere from two to 25,000 employees, across industries, per the methodology. The factor uniting the businesses represented in the survey was the presence of a human resources professional who is a member of SHRM, which indicates these are businesses with some human resources infrastructure and affordances.

In sum, surveys indicate that at least a minority of small businesses have found ways to bridge the affordability gap. According to ShareBuilder 401k, which offers 401(k) services to businesses, a small business with 10 employees might only pay $100 monthly in administrative services fees when setting up a 401(k). Moreover, these costs are tax deductible and small businesses setting up their first 401(k) plan are often eligible for tax credits.

The following sources were critical to our analysis:

It’s important to note that in this metric, we focused only on private-sector workers, aiming at a quantitative estimate for the percentage with access to 401(k) plans. Government workers, i.e. public-sector workers in state and local government, are excluded from these estimates. Although these government workers constitute a workforce of some 19 million people as of March 2023, these workers have significantly higher proportions of participation in defined benefit pension plans, and significantly lower proportions of participation in defined contribution plans, including 401(k)-type plans. For this reason, it would make little sense to combine them into estimates for access and participation in retirement benefits. Indeed, the BLS states that the “incidence of employee benefits in state and local government should not be directly compared to private industry.” Federal workers and military personnel are also not included in this report, and they form their own separate categories in BLS data.

This analysis bases itself on two datasets:

With these two sources, we can arrive at a meaningful estimate of the percentage of American workers with access to 401(k) type plans. The methodology has several key steps:

That said, there’s no reason to think that 401(k) plans will be any more (or less) miscounted than the number of 403(b) plan participants or any other type of DC plan.

We believe our estimates are well-supported because they rely on a simple methodology that builds on two long-running federal government data sources. The first is part of the National Compensation Survey and another is based on data collected via Form 5500. The latter, without modification, serves us as a conservative proxy for the prevalence of 401(k)s within the defined contribution-plan ecosystem. With this two-step methodology, we arrive at a meaningful estimate for the adoption of 401(k) accounts in the US, and a useful metric with which to track the uptake of 401(k)s among future retirees.

1 Employee Benefits Security Administration, Private Pension Plan Bulletin, Abstract of Form 5500 Annual Reports, according to the US Department of Labor.

2 Employee Benefits in the United States series, from the National Compensation Survey; 2019 to 2024, according to BLS.

3 Annual Employee Benefits Survey, 2023 and 2024, according to SHRM.

4 Data on 401(k) plans with employer contribution, according to Fidelity.