Navigate the latest financial trends to make the best rollover decision for you.

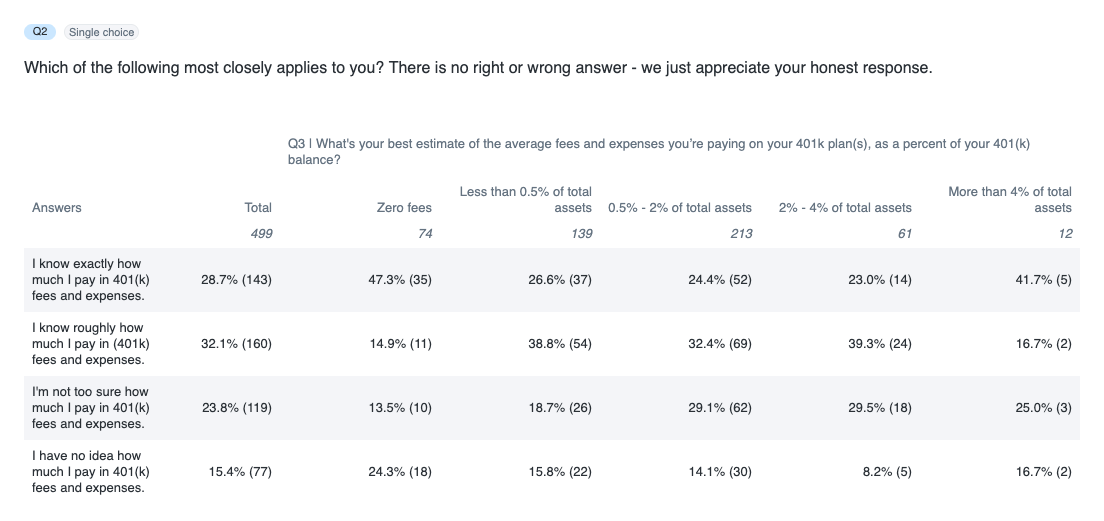

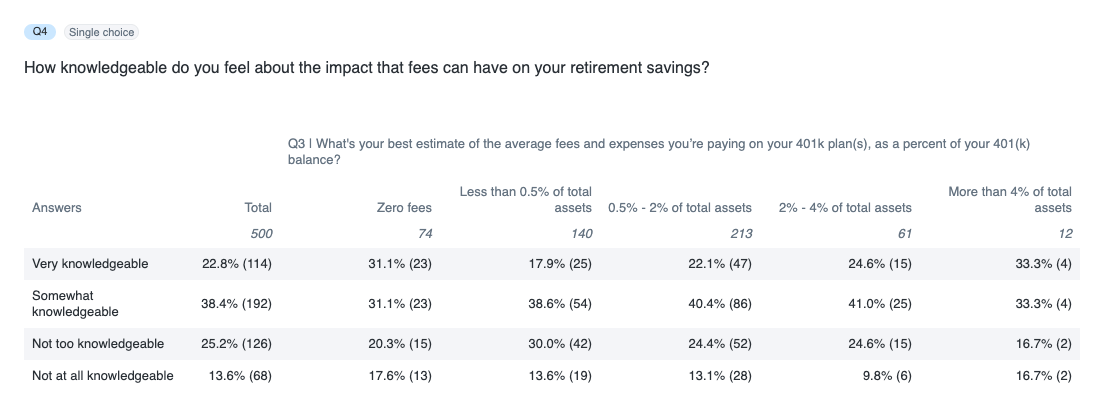

Start My RolloverCapitalize, an award-winning 401(k) rollover service, conducted a survey of 500 respondents to gauge awareness of 401(k) fees as part of its ‘America Saves’ week initiative. The survey revealed that 401(k) fees remain a black box for the majority of Americans, with two-thirds (71%) responding that they don’t know the amount they’re currently paying in fees.

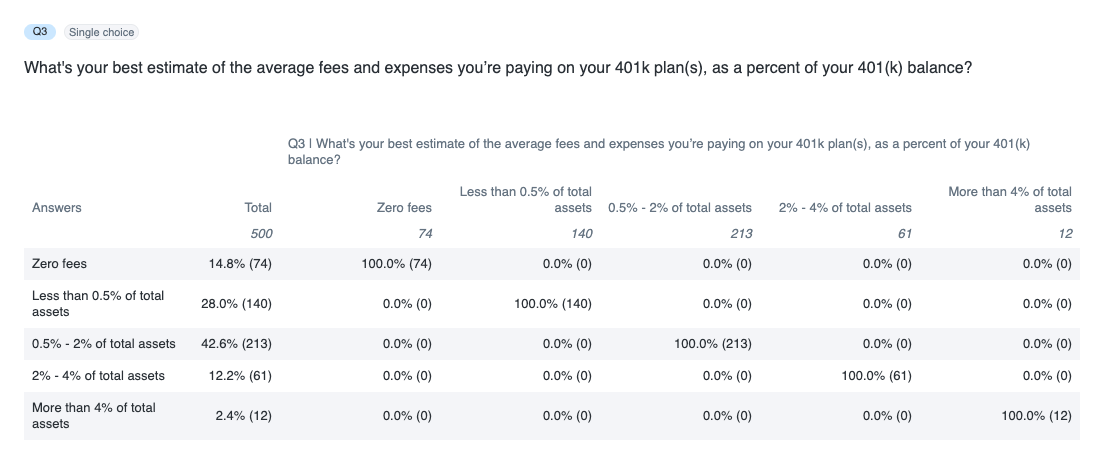

Additionally, Americans grossly underestimate how much they’re paying and therefore just how much they can save. Nearly half estimate they’re paying less than .5% of total assets in 401(k) fees and costs – but only 10% of all plans charge less than .4%. The unfortunate reality is that paying higher 401(k) fees than you need to can add years onto your working life.

Imagine two people, both of whom are 25 years old, earn $100,000, and will be ready to retire as soon as they’ve personally amassed $1,000,000 in retirement savings. Ryan annually invests $10,000 into his 401(k) plan on a pre-tax basis and is able to earn an average of 8% on his investments. The investments available in his 401(k) plan are expensive, though, and average a cost of 2% annually. As a result, Ryan’s net annual return is 6% (8% gross return less 2% in expenses). Assuming these variables, he can expect to retire at age 58.

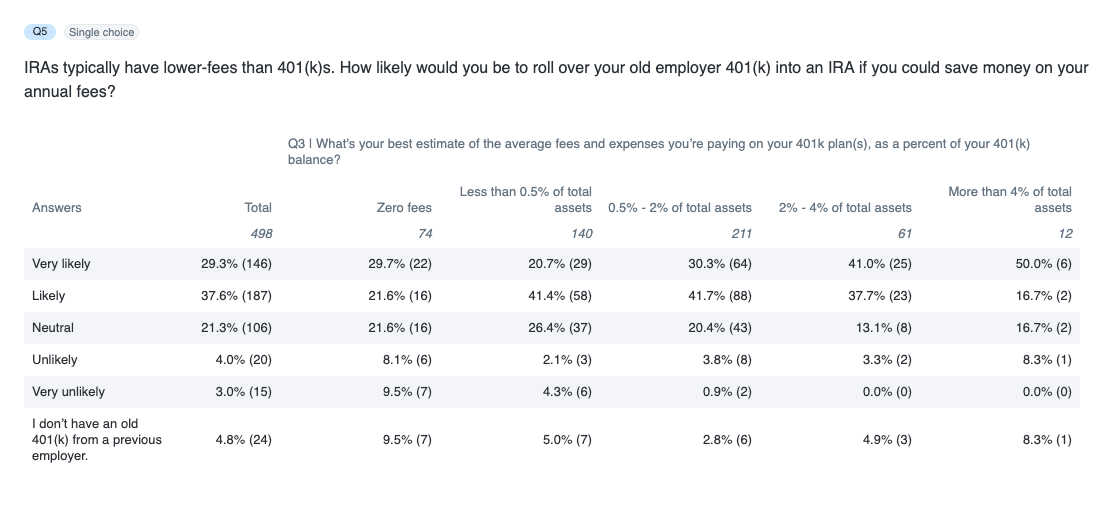

The second person, Haley, is the same age, earns the same salary, and makes the same 401(k) contributions. However she has elected to invest in lower-cost options in her 401(k) plan and pays .50% annually in total fees. As a result, her net return every year is 7.5% (8% – 0.50%). Assuming these variables, Haley can plan to retire at age 54. That’s 4 years earlier than Ryan, all because she was aware of the impact fees can have on her returns. When negotiating jobs, we talk about leaving money on the table 一 but what about giving up years of our lives when we quit and leave behind our 401(k)s?

401(k) fees are easy to ignore, but there’s a lot at stake when you do. How do you make sure your old 401(k) isn’t costing you big?

We surveyed 500 respondents through Attest to explore consumers’ knowledge of 401(k) fees. Respondents in this study ranged in age from 26 to 57, had at least 1 401(k) account, and were employed full-time. 50% of respondents were millennials, and 50% were members of Gen X. 50% of respondents were men, and 50% were women. This study relies on self-reporting and thus has limitations including, but not limited to, telescoping, exaggeration, and selective memory.