Make sure your TIAA 401(k) is working for you

Making changes to your TIAA 401(k) portfolio can help you make sure that your investments are in line with your unique financial situation and goals. As a general principle, financial planning experts suggest investors should be:

- more aggressive when you have a long time horizon until retirement, because you’ll be able to ride out market fluctuations to increase your potential for higher returns

- increasingly conservative as you approach retirement, to protect your returns

Before making changes, make sure you’ve considered all of the investment options in your 401(k) plan (your employer usually chooses around 20 options).

We want to make it easy for you to make changes to your TIAA 401(k) portfolio – check out the guide below to get step-by-step instructions.

Step-by-step guide to make changes to your TIAA 401(k) portfolio

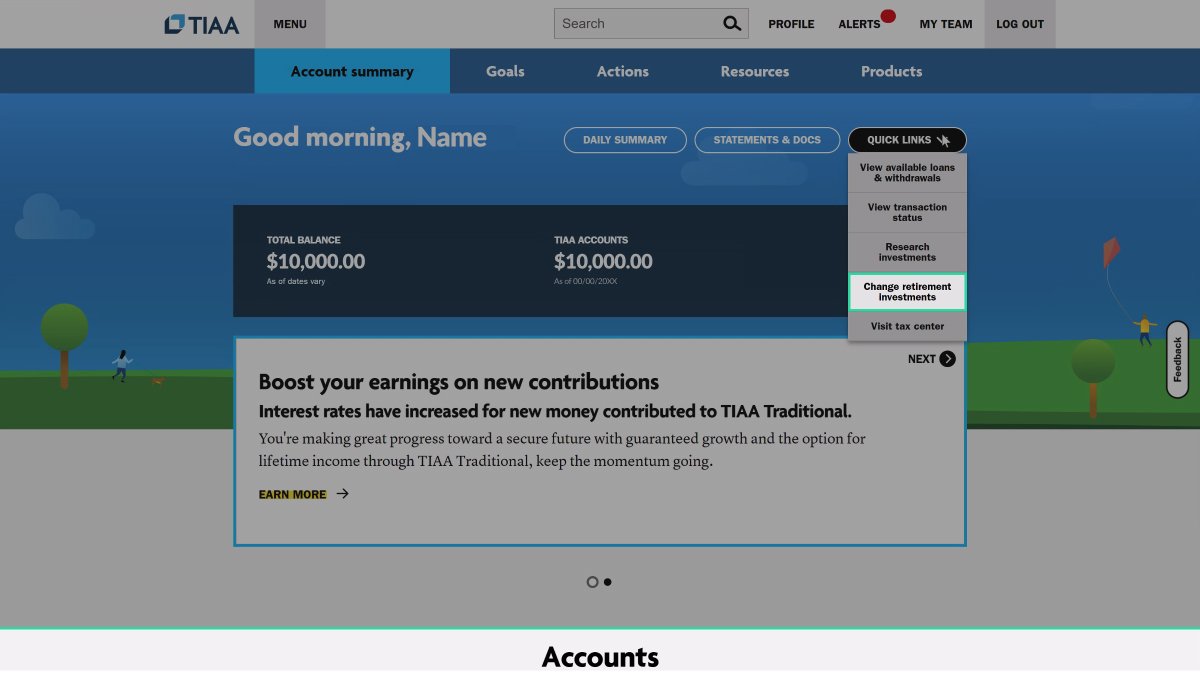

- Log in to TIAA.

- Click on “Quick Links” and then on “Change retirement investments”.

- You’ll need to change the current investments in your portfolio, as well as change your investment elections for any future contributions to this account. We’ll also cover re-balancing.

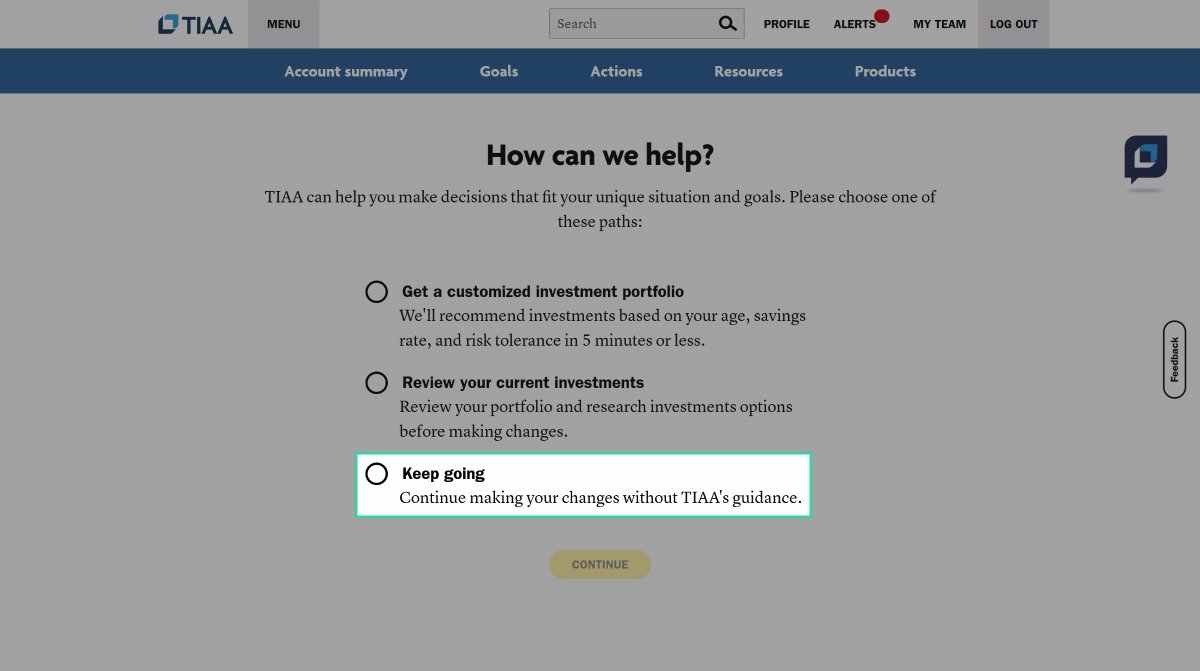

- Select “Keep going”.

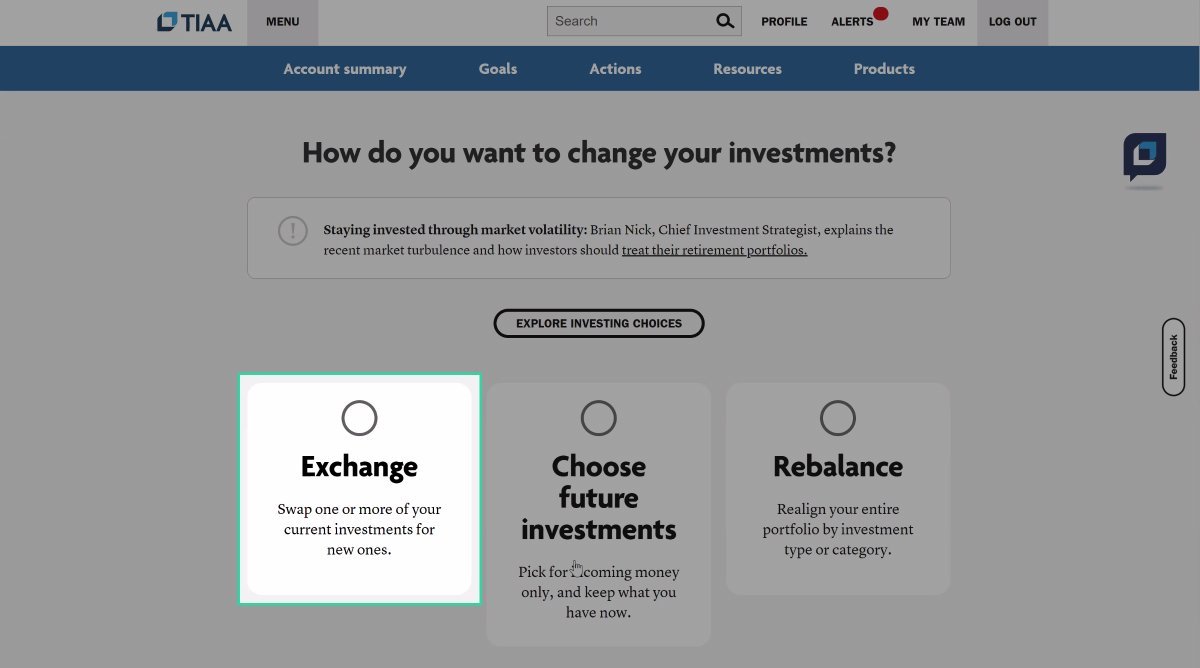

- Select “Exchange” to change the current investments in your portfolio.

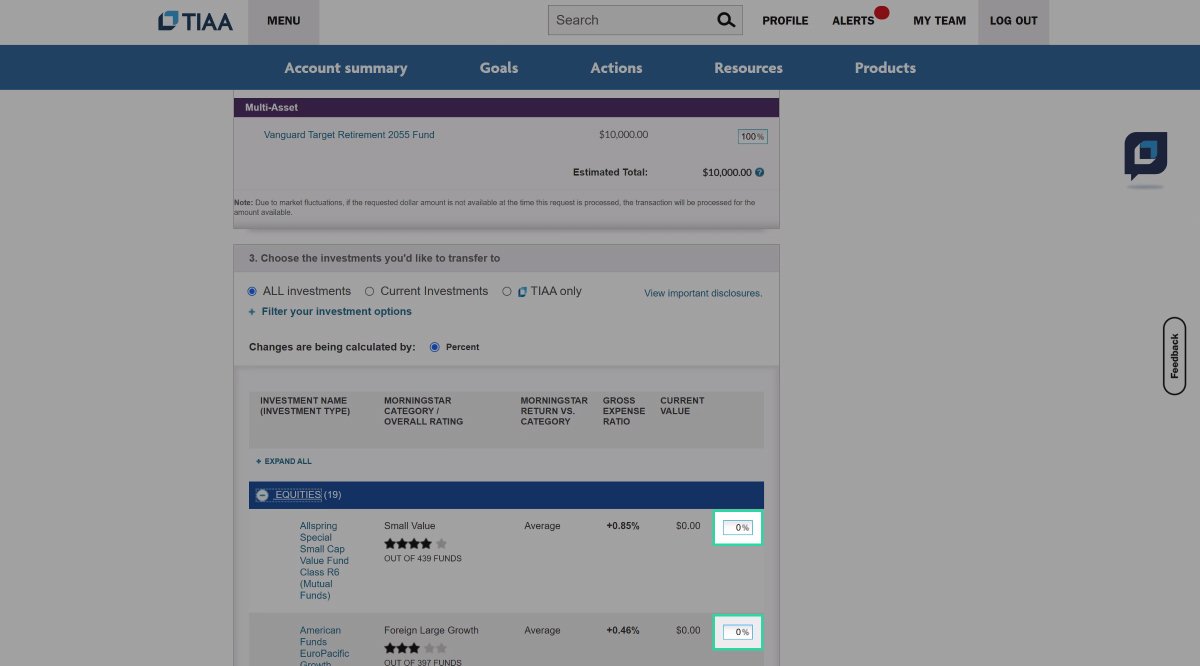

- In Step 2 on the page, input the desired % allocation to each of your current investments. In Step 3 on the page, input the desired % allocation to any few funds you’d like to add to your portfolio. Make sure to save your changes.

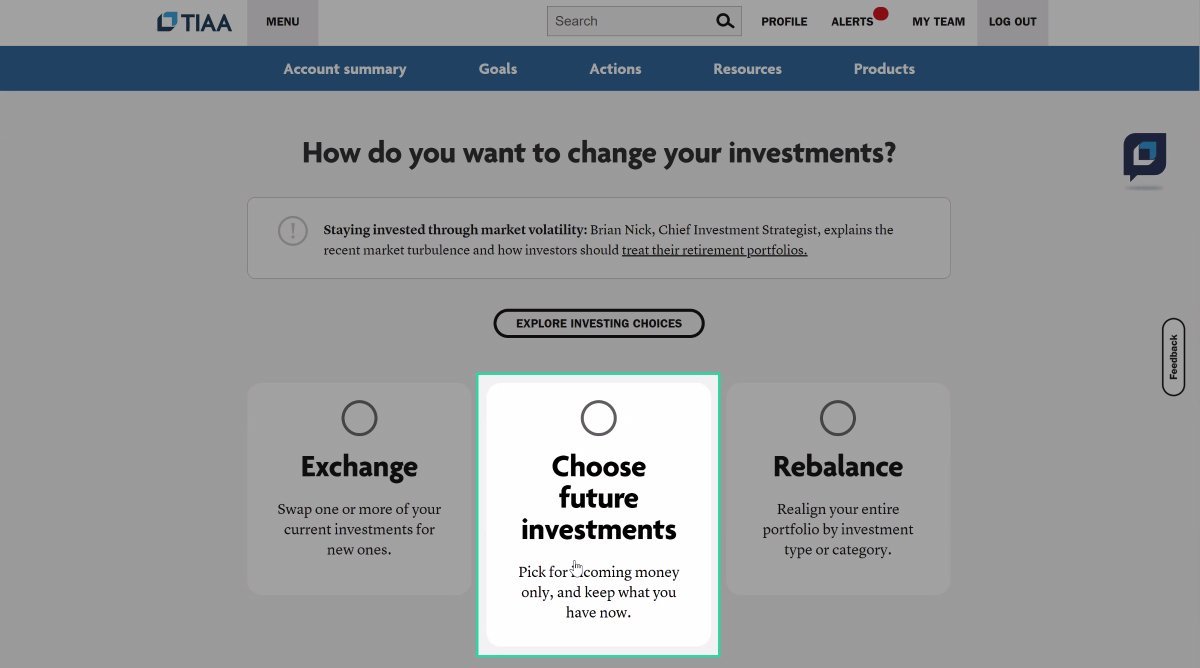

- Next, we need to change your future contribution allocations. Navigate back to “Change retirement investments” and select “Choose future investments”.

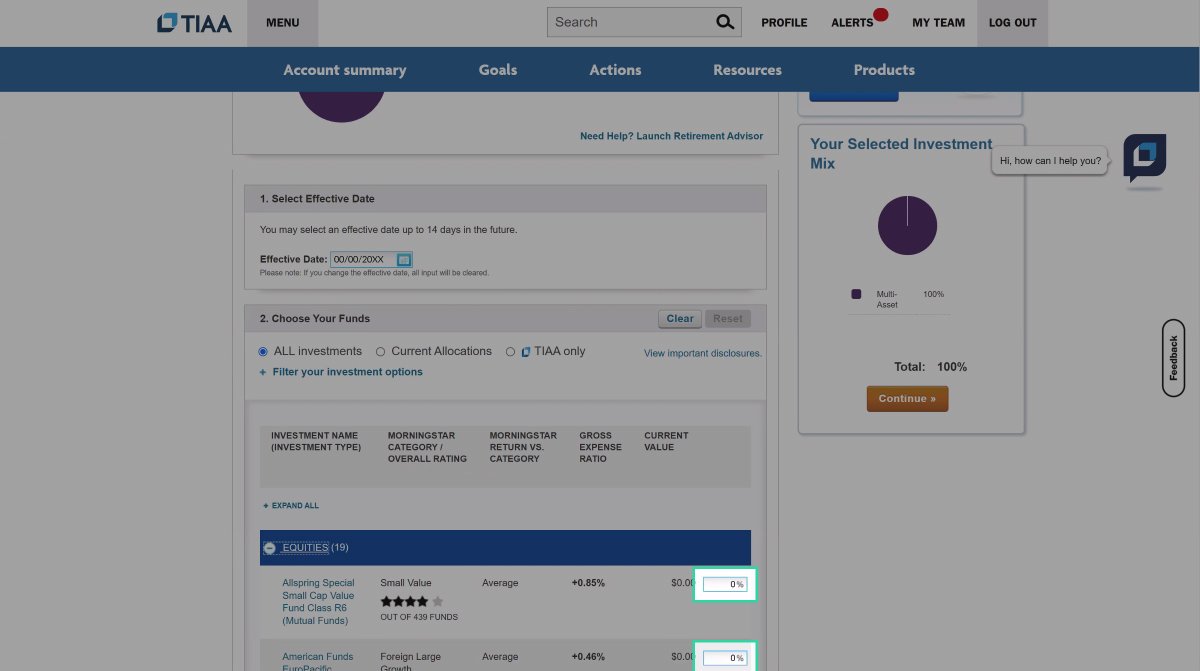

- Input the desired % allocation to each of the funds. Make sure to save your changes.

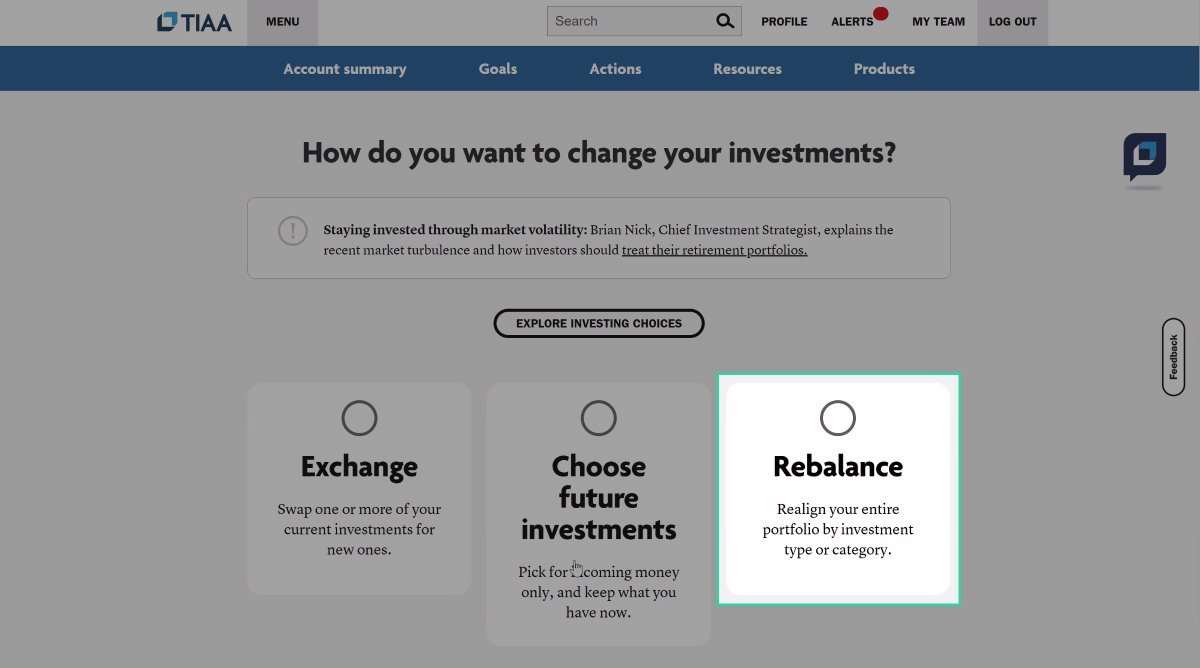

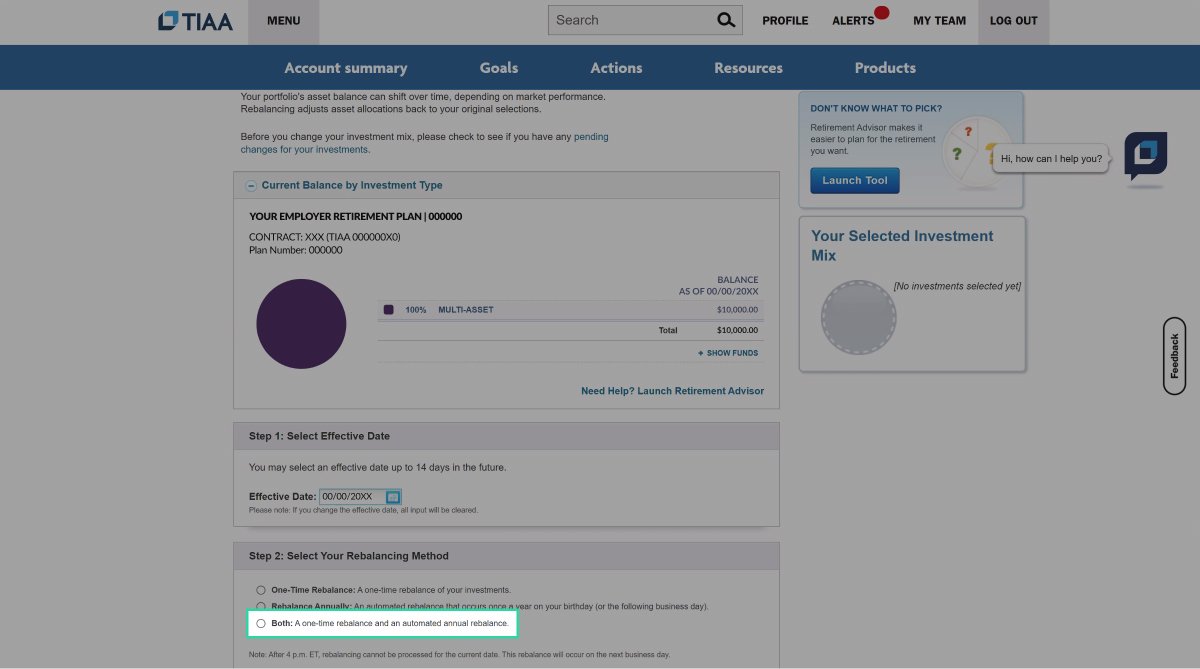

- Lastly, let’s set up automatic rebalancing in the future. This will keep your portfolio aligned to your Capitalize recommendation, even as the value of your individual investments change. Navigate back to “Change retirement investments” and select “Rebalance”.

- Next, choose your re-balancing method in Step 2. We recommend to choose “Both”, which includes a one-time and an annual rebalance. Make sure to save your changes.

- You’re all set!