Key Benefits of Choosing Fidelity for Your 401(k) Rollover

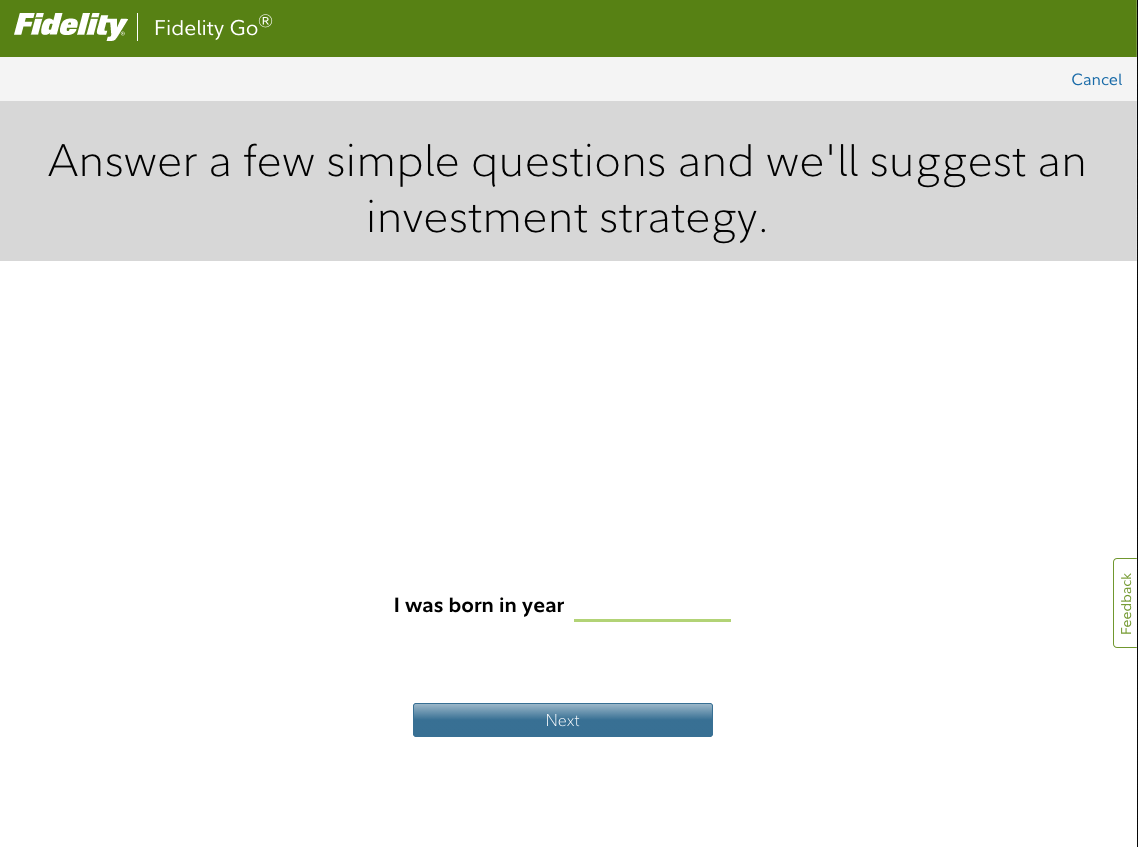

When considering a rollover of your 401(k) retirement plan, it’s important to select the right financial institution that offers the most advantages.

Fidelity Investments emerges as an excellent choice for your rollover needs, providing a range of benefits and services.

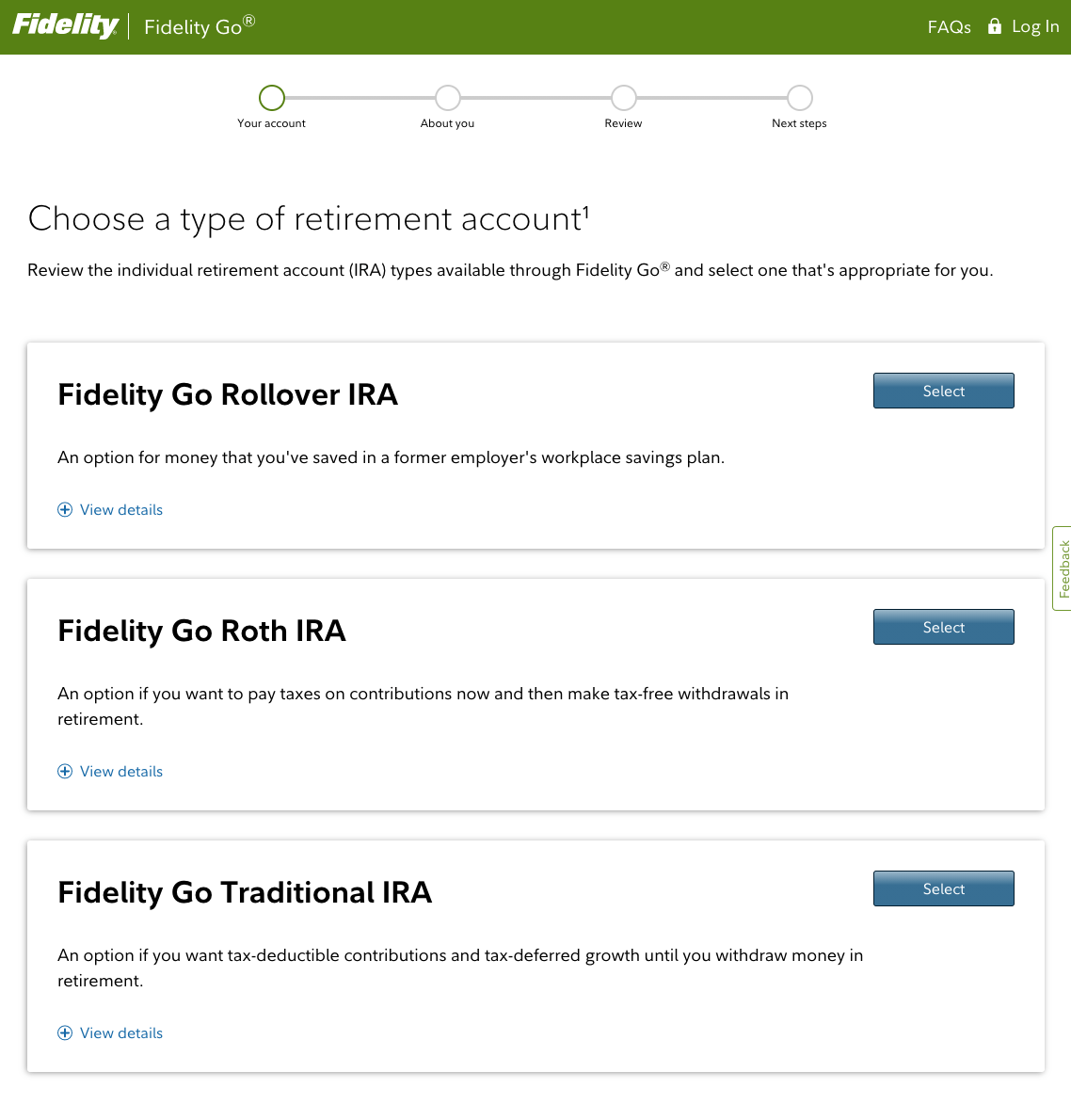

- Tax-advantaged Opportunity: You won’t pay taxes on potential growth until you make withdrawals—and can still make contributions to the account. What’s more, moving money from a former workplace plan to a Fidelity rollover IRA is free from taxes or penalties.

- Penalty-Free Access to Funds for Important Expenses: Fidelity offers the advantage of penalty-free withdrawals for specific expenses, providing you with greater financial flexibility. Whether it’s a first home purchase, a momentous life event like a birth or adoption, or college expenses, you can access your rollover IRA funds without incurring any penalties.

- However, it’s important to note that a 10% early withdrawal penalty may apply for other withdrawals taken prior to reaching the age of 59½, highlighting the significance of careful financial planning.

- Enhanced Investment Flexibility: A rollover IRA with Fidelity offers you a wider range of investment choices compared to employer-sponsored plans. This increased flexibility allows you to craft an investment portfolio that aligns with your unique financial goals and risk tolerance. Fidelity provides a diverse selection of investment options, including mutual funds, company stocks, bonds, ETFs, and more. This empowers you to make strategic investment decisions and diversify your portfolio for potential growth.

- Required Minimum Distributions (RMD): While enjoying the investment flexibility of a rollover IRA, it’s important to be aware of the requirement to take annual distributions once you reach the age of 73 (commonly referred to as the Required Beginning Date). Fidelity assists in managing this obligation by ensuring compliance with the IRS’s required minimum distribution (RMD) rules. They can guide you through the process of withdrawing a specific amount from your rollover IRA each year, ensuring adherence to the regulations while preserving your retirement savings.

For those interested in initiating a rollover, you can find Fidelity’s address below for reference:

Fidelity Investments

100 Crosby Parkway KC2Q

Covington, KY 41015

You can also visit fidelity.com to view other mailing addresses.

Conclusion

401(k) rollovers are a great way for you to tax-efficiently transfer the savings in old 401(k) accounts you have. If you roll over into an IRA, you may also be able to invest in a wider range of assets.

The process can seem a little daunting, but there are just five key steps to follow. Most people who complete a rollover are glad they did. The assets in accounts like your IRA will probably end up being your biggest source of financial support when you retire. Investing a little time to get those assets set up and working for you in the right way can really pay off.

If you’re looking for additional tax advice, consider working with a qualified CPA or other credentialed tax advisor before effecting your Fidelity IRA transfer. Before investing, be sure to read the prospectus for any fund you might be considering.