Although HSA contributions are generally referred to in terms of annual limits, did you know that if you meet the HSA contribution eligibility requirements for only part of the year, your HSA contribution limit will be prorated?

Read on to learn more about how to determine your eligibility.

How do I determine if I am eligible for a contribution each month?

Your eligibility for a given month is based on your coverage on the first day of the month. So, if you’re covered on February 1st, you’re eligible for a contribution for February. If, however, your coverage didn’t start until February 2nd, you wouldn’t be eligible for a February contribution.

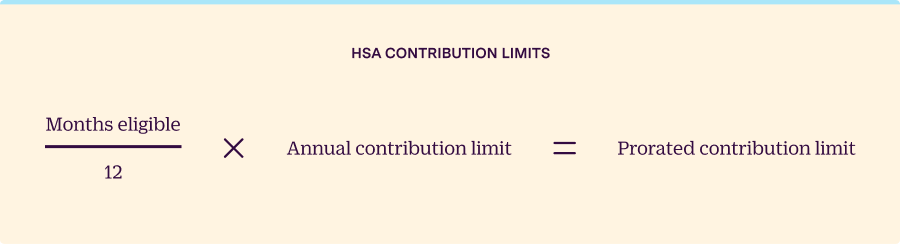

How do I calculate my prorated contribution for the year?

Now that you know the number of months you were eligible to make contributions, divide that number by 12 and multiply by your contribution limit for the year (i.e. $3,850 for an individual in 2023).

But of course, this comes with two important caveats: the last month rule and the testing period.

What is the last-month rule?

The last-month rule stipulates that if you are eligible on the first day of the last month of your tax year – December 1st for most people – then you’re considered eligible for that entire year. For example, if you’re not eligible until December 1st, you can still make the full annual contribution up to your limit for the year.

Important: This assumes that you remain eligible through the testing period, which we’ll discuss below.

What is the testing period?

If you’ve become eligible for a full year of contributions under the last-month rule, you also must remain eligible until December 31st of the following year.

If you violate the testing period requirement, you’ll have excess HSA contributions if you contributed more than your annual maximum for the previous year. If they aren’t removed by the tax deadline, excess contributions will become taxable income for the tax year in question, and will also be subject to a 10% penalty.

Note: The only exceptions to the testing period requirement are death or disability.

What happens if I contribute too much?

Excess contributions in your HSA are subject to ordinary income tax in addition to a penalty.

To avoid being taxed on excess contributions – and, to escape the penalty – you should process a specific form with your HSA provider related to excess contributions if you’ve accidentally contributed too much. Make sure to do this by the tax filing deadline of the following year.

Though it may be tempting, you shouldn’t attempt to withdraw the excess contributions on your own. Make sure to follow the process laid out by your HSA provider on their excess contributions form. Here’s an example of the form provided by HSA Bank.

What happens if I contributed too much and I’ve already invested these contributions?

If you invest your HSA contributions and then discover you’ve contributed too much, your HSA provider can withdraw not only the excess contributions, but also any earnings (or losses) on those contributions.

In addition to the excess contributions, you’ll also report any earnings on the excess contributions to your HSA provider. Check out this example of the form provided by HSA Bank – you’ll note the section to write in both excess contributions and any associated earnings.

In conclusion…

While the contribution and eligibility rules can be complex in certain scenarios, HSAs are a rapidly growing account type that many people are using to augment their retirement planning strategies.

To learn more about the power of HSAs and how they can contribute to your retirement planning, check out our article here.