Updated on January 20, 2023

Learn about our Editorial Process

Millions of Americans retire each year. Behind them is a young and eager group of new workers anxious to make their mark on the world. Yet, there appears to be a gap between the amount workers are tucking away for retirement versus the amount they want available in their golden years.

To better understand how all generations, especially Gen Zers and millennials, view retirement, we asked a cross-section of workers about their retirement savings strategies.

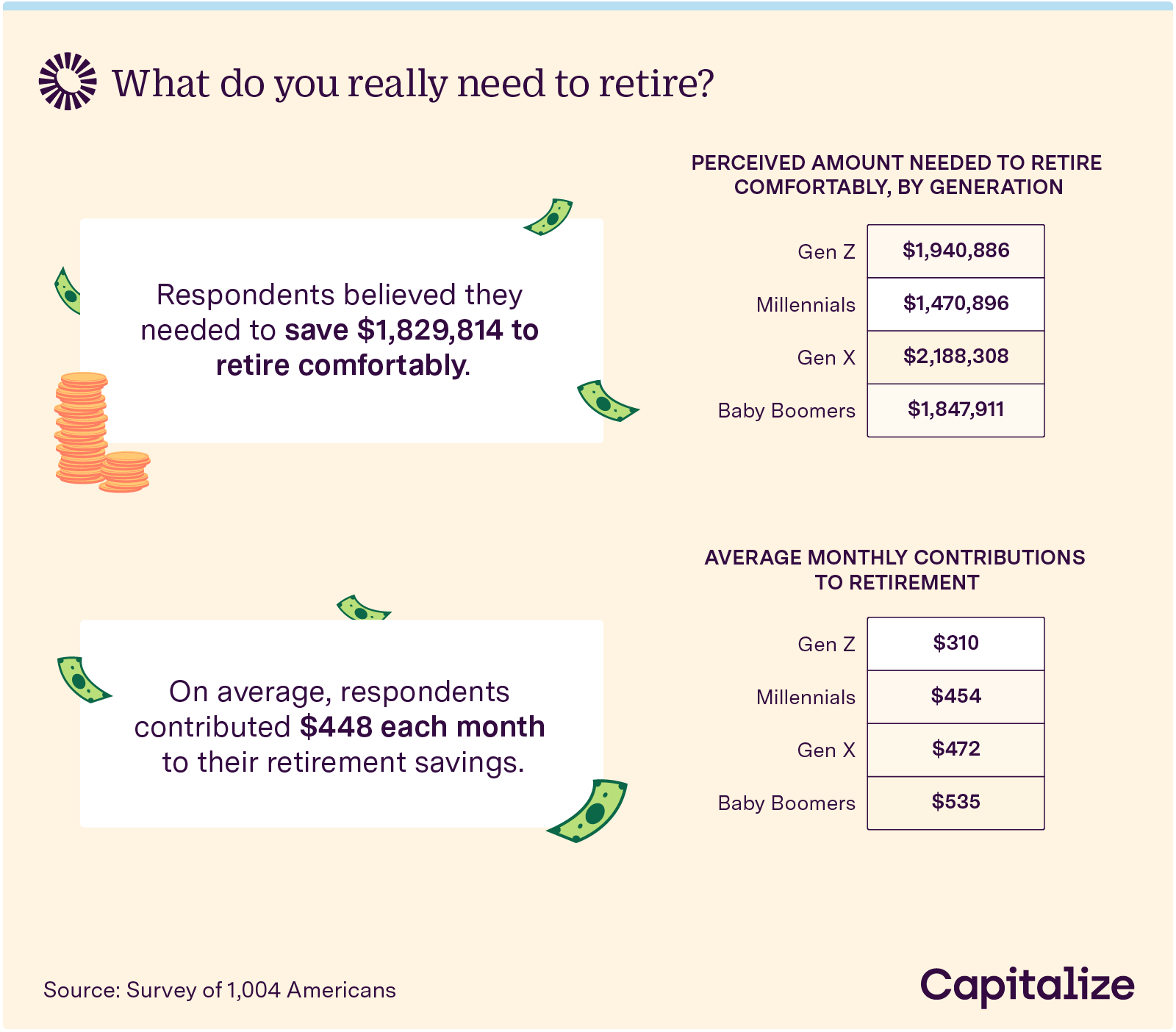

On average, our respondents estimate they need about $1.8M in retirement savings to live a comfortable post-career lifestyle. However, the average monthly amount contributed to retirement accounts is only $448, which isn’t enough for most.

A shortfall in retirement savings may also be why one-third of Gen Zers and millennials surveyed plan to work past their traditional retirement age or why over half rely on cryptocurrencies to boost their nest egg.

Tag along while we explore successful financial strategies and the pitfalls to avoid in retirement planning.

Gen Zers, Xers, millennials, and baby boomers feel they need between $1.4M to $2.1M to retire comfortably.

There are several strategies workers can implement to obtain their desired seven-figure retirement account. Let’s start with the basics. Experts recommend placing 10%–15% of your monthly income into a retirement or savings plan.

According to recent data from the Bureau of Labor Statistics, just over two-thirds of private industry employees have access to a 401(k) or other employer-provided retirement plan. Some workers, especially those in government, may have access to defined benefit plans. Regardless of the type, it’s essential to take full advantage of every available tool.

Baby boomers in our survey contribute the most to retirement accounts, averaging $535 monthly. Gen Zers only average $310 per month into their retirement nest egg. Millennials and Gen Xers fall somewhere in between.

Let’s look at a 25-year-old worker starting their retirement account with no retirement savings and earning $60,000 annually. Assuming a $310 monthly contribution (which is only 6.2%) to their company 401(k) plan, a 3% annual salary increase with a $.50 company match on the first 6%, and 6% average return, they’ll have about $1.35M saved at age 65. However, let’s suppose they increase their contribution amount to $500 per month under the same scenario. In that case, the account balance becomes nearly $2.18M, an increase of $830,000.

Of course, many factors impact these numbers, such as the amount contributed, interest rates, and how long you save. But with a bit of discipline and a long-term strategy, employees can reach their retirement goals.

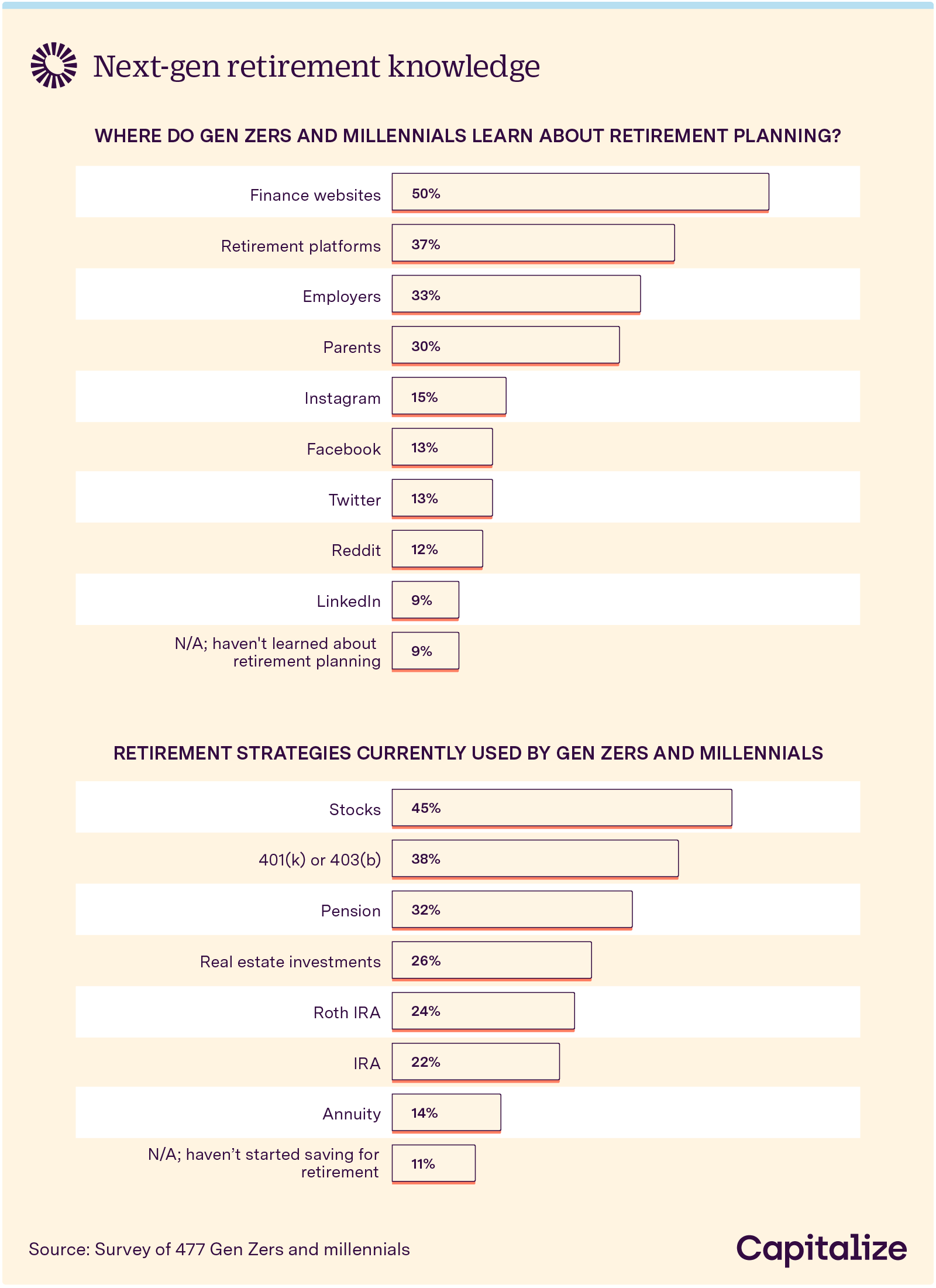

According to our findings, one-half of Gen Zers and millennials turn to financial websites for advice, with 37% relying on retirement platforms for customized portfolio insights.

Given they’re armed with so much investment knowledge, what tools do these aspiring investors use most? 45% favored stocks, with 38% relying on preset investment objectives in 401(k) and 403(b) plans. Slightly less than one-third use pension plans, which allow retirees to draw a portion of income earned during their working years.

Because of their jobs and tax laws, most employees don’t have access to every type of retirement plan, so let’s examine the differences between them.

Named after the Internal Revenue Service code that defines them, a 401(k) is a defined contribution plan offered mainly by private sector companies. A close cousin, 403(b) plans are similar and available to most public sector employees. Both are excellent investment vehicles that offer tax-free growth. Some employers will match all or a portion of the employee’s retirement fund contributions up to a certain amount, where it can grow tax-free until withdrawn. There are rules regarding early withdrawal (also known as cashing out your 401(k)) and contribution limits, so make sure you understand them.

Pensions are defined benefit plans where an employer (usually a government entity) sets aside a certain amount for an employee’s retirement based on their years of service and salary. Because they rely solely on employer contributions, few private employers offer them today.

Regardless of the type of retirement vehicle available, or whether you favor stocks, mutual funds, real estate, or crypto, it’s never too late to start saving for your future.

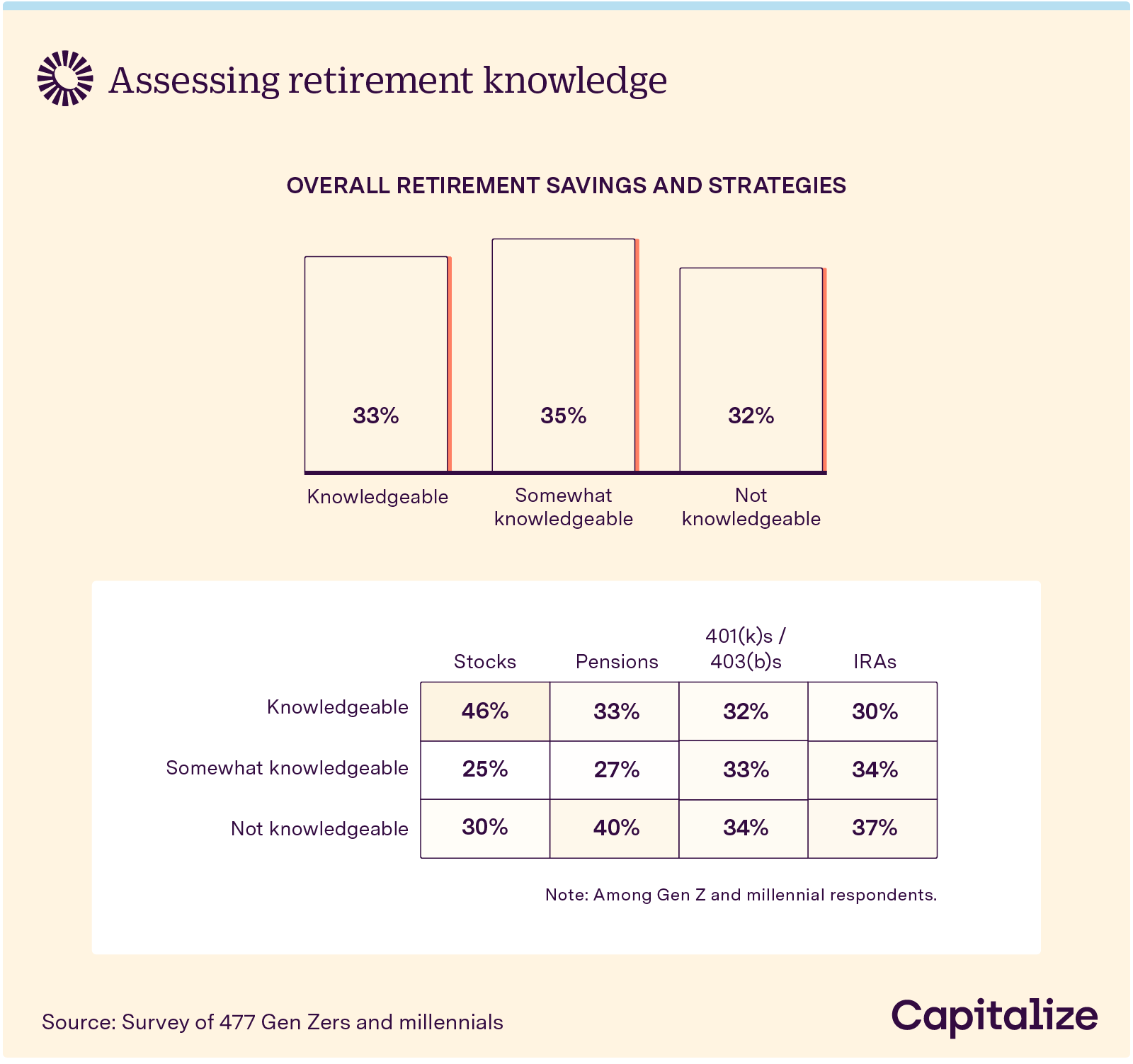

When it comes to investments, 46% of Gen Zers and millennials perceive themselves as knowledgeable about stocks, and another quarter admit to having some knowledge on equities. Around two-thirds express some understanding of employer-provided savings plans. Regardless of the retirement vehicle used, understanding the basics helps investors make wise decisions.

Depending on the plans offered by a company, employees can choose the percentages allocated to each type of investment. Younger investors, such as Gen Zers, have more time to reach their retirement goals and can afford to adopt a more aggressive investment strategy. On the other hand, baby boomers looking to retire soon usually adopt more conservative strategies to protect existing assets.

Think of your specific retirement plan as an umbrella. Under each 401(k) or 403(b) sit the investment tools, such as stocks, bonds, mutual funds, cryptocurrencies, real estate, gold, etc. Working together, these different investment tools can help you save up to the average $1.8M retirement goal.

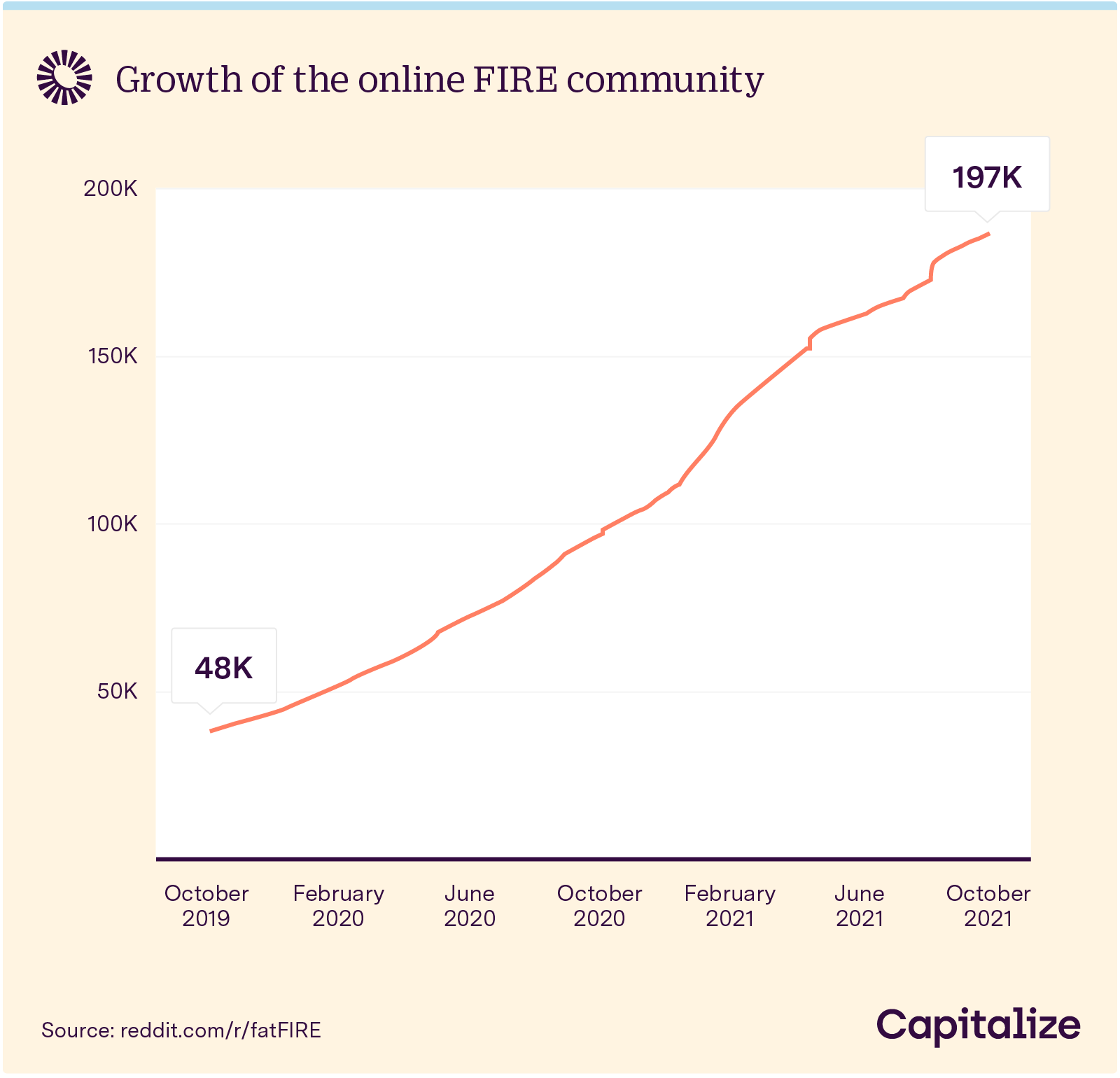

An increasing number of workers want to gain financial independence and retire early (FIRE). In October of 2019, the Reddit FIRE community numbered about 48K. A year later, it hit 100K and has almost doubled over the ensuing 12 months — a 300% jump!

Instead of investing 5%–15% monthly for retirement, FIRE followers often set aside 50% or more, usually requiring a monumental lifestyle shift. The popularity of cryptocurrencies may be one reason why young investors are visiting online financial forums. After all, 56% of Gen Zers and 54% of millennials surveyed planned to include cryptocurrencies in their retirement strategies.

Bitcoin is the most popular and highly valued cryptocurrency today. Unlike traditional currencies issued by governments, cryptocurrencies are designed, stored, and traded in a decentralized ledger system. Alternative currencies haven’t yet achieved widespread use, but nonetheless, millions of investors, including over half of the Gen Zers and millennials we surveyed, are taking advantage of them as an investment tool within their retirement accounts.

In April of 2011, the value of one Bitcoin reached $1; In November of 2021, it surpassed the $68,000 mark. Other cryptocurrencies have also experienced remarkable growth in recent years, but intelligent investors should always exercise caution when investing in alternative investments. They can fall as fast or even faster than they rose.

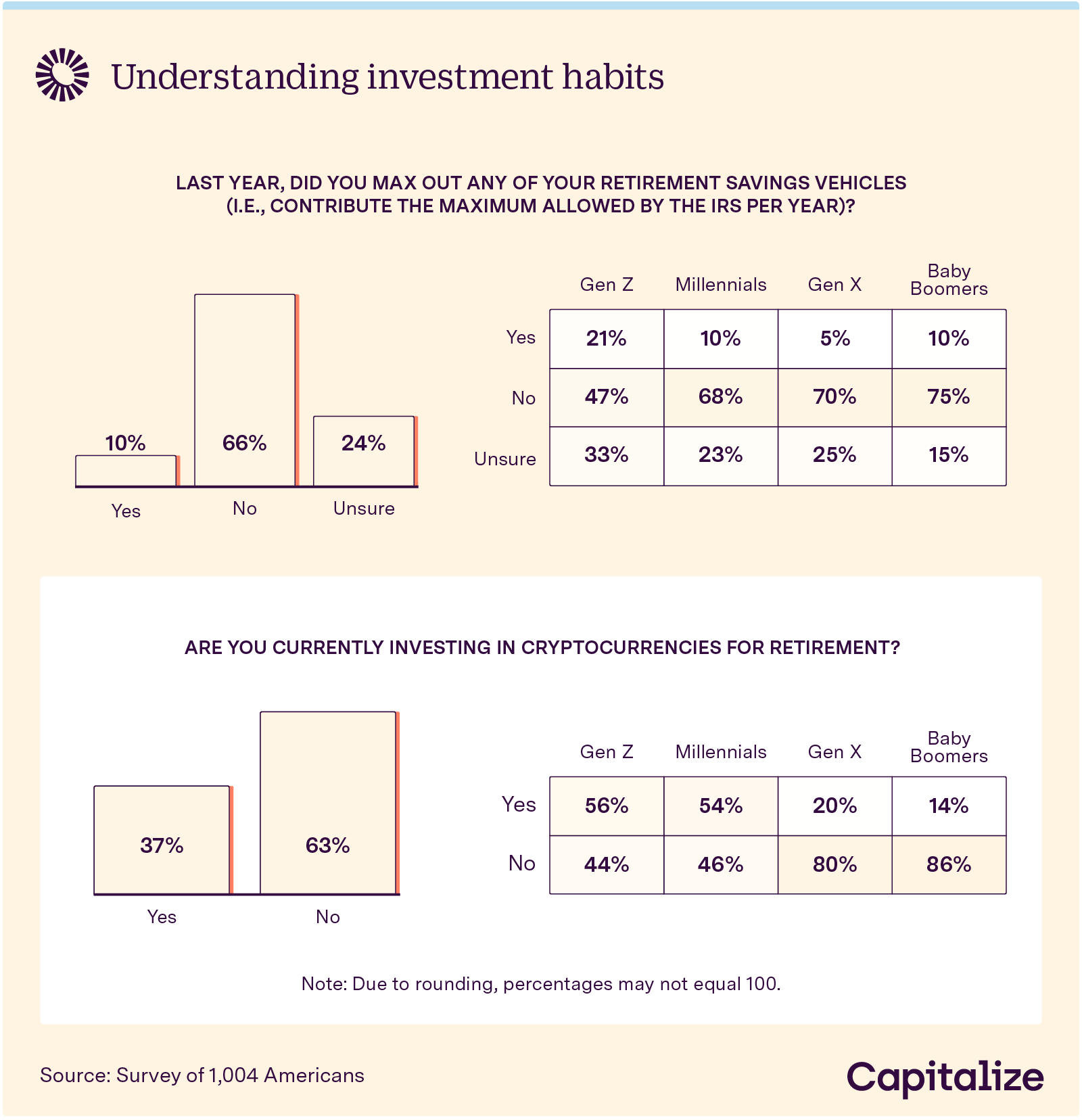

According to our survey, only 10% of people fully maximize their retirement contributions. While an impressive 21% of Gen Zers contribute the maximum amount to their retirement accounts, significantly fewer (10%) millennials do so. Only 5% of Gen Xers report maximizing retirement savings levels.

Private-sector retirement options, such as 401(k) plans, limit the amount employees and employers can contribute. In 2021, employees can contribute a maximum of $19,500 to their 401(k) plan. Employees 50 or older can contribute an extra $6,500 annually to “catch up” on contributions missed in prior years. Federal law caps the employer and employee’s total contribution at $58,000, or 100% of the employees’ annual earnings.

Based on the example previously used, the 25-year-old Gen Zer earning $60,000 annually and contributing 15% of their gross pay will set aside $9,000. Assuming their employer matches $.50 of their contribution up to 6%, with an annualized 6% return, and a 3% annual salary increase, they’ll have nearly $3.07M at retirement.

Interestingly, 56% of Gen Zers and 54% of millennials include cryptocurrencies and other digital assets in their retirement strategy, compared to only 20% of Gen Xers and 14% of baby boomers.

Employees saving for retirement also want to pay close attention to how their money is allocated. Financial experts often recommend that younger employees keep a higher percent in stocks since they have longer to ride out market fluctuations. Most professionals advise older employers to reduce unnecessary portfolio risk, which explains why baby boomers are less enthusiastic about cryptocurrencies than younger coworkers.

Regardless of the allocation strategy used, investors should carefully consider how much risk they can assume to reach retirement objectives safely.

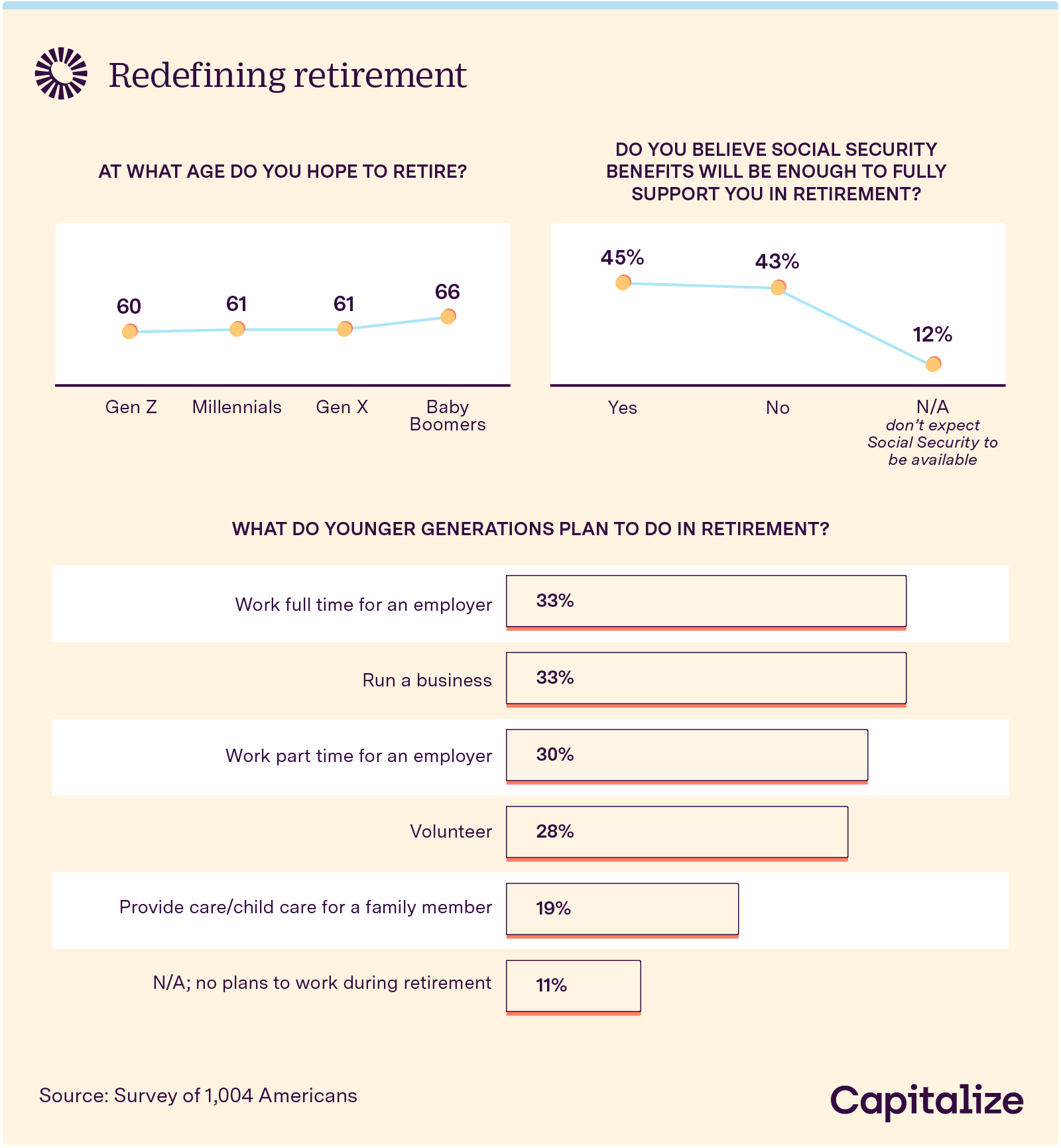

For years, 65 has been the noted retirement age. However, the average lifespan of Americans is also increasing. Baby boomers want to retire by age 66, and Gen Zers plan to stop working at 60. Millennials and Gen Xers agree that 61 is the right time.

In 1960, the average combined life expectancy was a tad under 70. Fifty-five years later, it increased to slightly under 80. That means, on average, a 66-year-old baby boomer today has 13 or so years to spend retirement savings. In 2060, the U.S. Census Bureau predicts average life spans will be 86, giving a Gen Zer more time to enjoy retirement.

Those newer to the workforce have a different view of retirement. One-third of respondents expect to work for another employer or start their own business once they hit traditional retirement age. Just under 30% want to volunteer at retirement age, while an equal percentage say they want a part-time gig. One-third of millennials and Gen Zers plan to still work full-time when they reach retirement age; with 43% believing that social security benefits would not be able to support them in retirement. Whether these work plans are implemented to avoid boredom or ensure financial security remains to be seen.

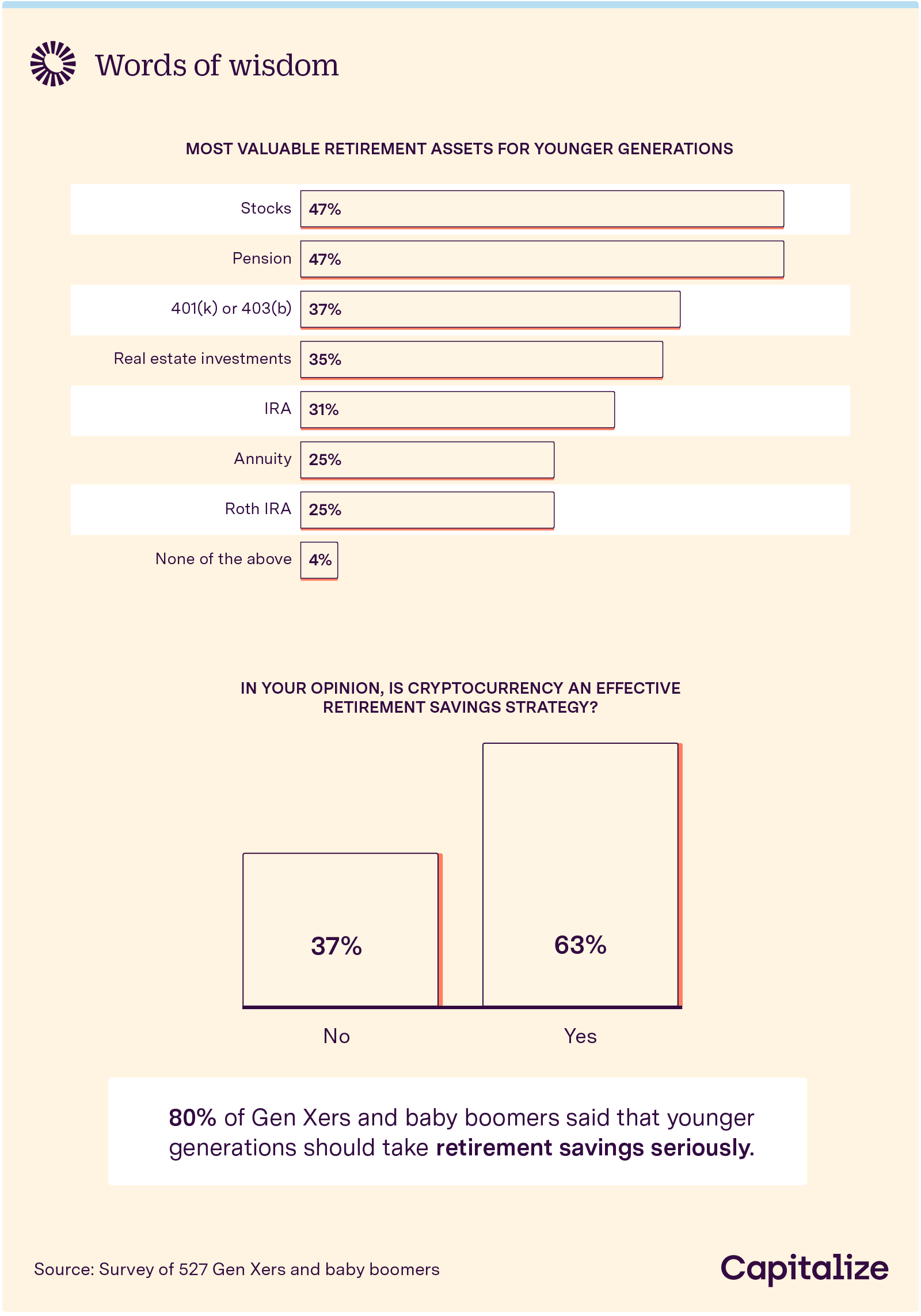

Older workers are often an excellent resource for their younger counterparts, whether offering insight on handling job-related tasks or investment advice. Since 80% of Gen Xers and baby boomers recommend paying close attention to retirement savings, younger workers could benefit from following suit.

It’s easy for investors to fall for flashy new investment schemes, employees wanting to maximize their retirement accounts should think long-term. That’s why 47% of Gen Xers and baby boomers recommend taking advantage of stock and pension plans. Since 1986, the S&P 500 has seen returns as high as 37.2% in 1996, with a -37% return in 2008. However, between 2000 and 2019, the S&P averaged an annual return of 8.87%. All markets will vary from year-to-year, but overall returns of at least 7% will increase the bottom line.

Seasoned workers also advise self-employed individuals or those changing careers to maximize IRA options. Depending on an employee’s situation, both traditional and Roth IRAs are valuable investment tools.

As for cryptocurrency, 63% of Gen Xers and boomers are bullish on including virtual coins in retirement portfolios, though only 14% are personally investing in them. When it comes to speculative investments or those without a long-term track record, it’s smart never to invest more than you can afford to lose.

It’s not easy keeping track of all your retirement needs and accounts, but it’s a critical part of achieving retirement bliss. It’s especially important to know your options for what to do with your 401(k) when changing jobs. The stakes are high: A study by the Center for Retirement Research indicates that leaving behind a 401k when you switch jobs could cost you as much as $700k in retirement savings. Fortunately, Capitalize is here to help you with a free service to find your old 401(k)s and consolidate them over into the best IRA account for you.

This study uses data from a survey of 1,004 Americans located in the U.S. Survey respondents were gathered through the Amazon Mechanical Turk survey platform where they were presented with a series of questions, including attention-check and disqualification questions.

58% of respondents identified as men, while 42% identified as women. Respondents ranged in age from 18 to 70 years old with an average age of 34. 13% of respondents were Gen Zers, 34% were millennials, 32% were Gen Xers, and 21% were baby boomers. Participants who incorrectly answered an attention-check question had their answers disqualified. Outliers were removed where the perceived amounts needed to retire and monthly contributions were questioned. This study has a 3% margin of error on a 95% confidence interval.

Please note that survey responses are self-reported and are subject to issues, such as exaggeration, recency bias, and telescoping.