According to AARP, nearly half (48%) of private sector employees between 18 and 64 years of age are employed at a company that does not offer a retirement savings plan. That means almost 57 million people may be unable to maintain their current lifestyle during retirement.

Additionally, the Center for Retirement Research at Boston College found that only half of Americans are saving enough (10 times their annual income) for retirement, which means at least 50% will not have enough savings and income sources to maintain their current standard of living in retirement.

Based on national averages, many people you know — maybe even you — fall into this predicament.

Even more concerning, research shows that 1 in 4 Americans who are not yet retirement age have no retirement savings, and women and people in underrepresented populations are more likely not to have enough savings.

The good news is many states are making it easier for workers to save money for retirement with state-facilitated retirement programs. Capitalize conducted a comprehensive review of the current state retirement legislation to help employees, employers, and other stakeholders understand the current landscape and options.

By understanding the effect the legislative landscape has on your retirement savings, you can make the best investment and saving decisions for your situation. You can even make voting decisions in your state based on what you discover about pending legislation.

The gap in many Americans’ retirement savings is a multifaceted issue. Many people do not save due to poor planning, frivolous spending, or a combination of these factors. However, lack of access to workplace savings plans is another underlying issue for many people.

Many headlines focus on small businesses not providing savings options, but that’s only part of the issue. AARP surveys have found that 3 out of 4 workers at companies with fewer than 10 employees do not have access to a retirement plan. Surprisingly, 1 in 3 people working at companies with more than 1,000 employees also do not have access to an employer-sponsored retirement plan.

For some people without access to employer-sponsored plans, Solo 401(k)s and SEP IRAs offer a way to save for retirement. However, these options are limited to people who are self-employed with no employees other than themselves.

“If we don’t have the ability to get [workers] involved in generating a real nest egg, then it’s going to prove to be high rates of elderly poverty in those states long-term,” Benjamin Glasner, associate economist at EIG, told CBS MoneyWatch.

“Saving for retirement can be hard, especially when so many don’t have access to a retirement account through their employers. State-sponsored auto-IRA programs are helping expand the ways in which Americans can access and contribute to retirement accounts. State IRAs may never replace 401(k)s, but more people saving for retirement in any account helps us collectively move to better outcomes in retirement.”- Gaurav Sharma, CEO of Capitalize

Geography also plays a role. EIG found that employees in the Midwest have the highest odds of having a retirement plan at work, with 49% of survey participants responding in the affirmative, and workers in the South (42%) are the least likely. The study also reported that politics at the state level likely does not play a role. CBS pointed to California, a democratic state, as having one of the highest levels of employees without access to an employer-sponsored retirement program.

The lack of access is not equal across gender, race, and ethnicity. AARP found that the majority of Hispanic workers (64%) and Black workers (53%) have no access to workplace retirement plans. The study found that these workers make up 46% of the uncovered workers, representing 26 million people without access to retirement savings plans.

In response to the retirement savings access gap, many states have passed legislation to create state retirement programs for private sector employees without access to any retirement plan at work. These programs are often known as “state auto-IRA programs.” In a state-sponsored retirement plan, 4-6% of the employee’s salary is automatically contributed to an individual’s retirement account through payroll deduction.

The state-level legislation is in addition to efforts at the Federal level, referred to as SECURE.2.0. The new federal legislation requires employers with a retirement plan to automatically enroll eligible employees with a minimum contribution of 3% of their salary. However, the state programs tackle the retirement savings problem from a different angle. State programs give employers a low-cost and easy way to help employees maintain their standard of living in retirement.

The goal of the state programs is to reduce the savings gap by providing access to retirement savings plans to as many Americans as possible. Many states are primarily focusing their efforts on providing options for employees of small businesses.

While each plan has some differences, covered employers in the state choosing not to offer any type of retirement plan must facilitate enrollment in the state’s plan for their workers. Under federal law, the programs must be employee-pay-all; employers may not contribute on behalf of their workers, so the program is cost-free to employers.

To make it easy to save, the employee’s savings is deposited into the program through payroll deduction.

Liability for not facilitating enrollment is usually based on the number of employees, as well as whether employees have access to a retirement plan at work. To make contribution easy, auto-IRA programs automatically enroll eligible employees at a set rate of pay, with the option to change the contribution level or opt-out entirely at any time.

Though there’s no data yet on opt-out rates in the U.S., a similar program in the UK offers what might be comparable results, according to the Pension Research Council at Wharton. Between 8 and 11 percent of employees opt out of the program at companies with 50 or more employees, and 17% opt out at companies with 19 or fewer employees.

To make it easy to save, the employee’s savings are deposited into the program through payroll deduction. Employees control the amount deposited, with states allowing the ability to change the percentage throughout the year. Because the state manages the plan, the employer has zero management and administration responsibilities other than facilitating payroll withholding.

Employees in states that use Roth IRAs as the savings vehicle, which are the majority, are limited by the maximum Roth IRA contribution each year of $6,500, or $7,500 if 50 years of age or older. Employees earning above an IRS limit ($153,000 as a single filer in 2023) are not allowed to contribute to a Roth IRA; some programs other a traditional IRA as an alternative for those unable to or who otherwise prefer not to contribute to a Roth. Additionally, all current state-sponsored plans are portable, meaning that the money belongs to the employee, and they can roll over the retirement savings if they change jobs or move states.

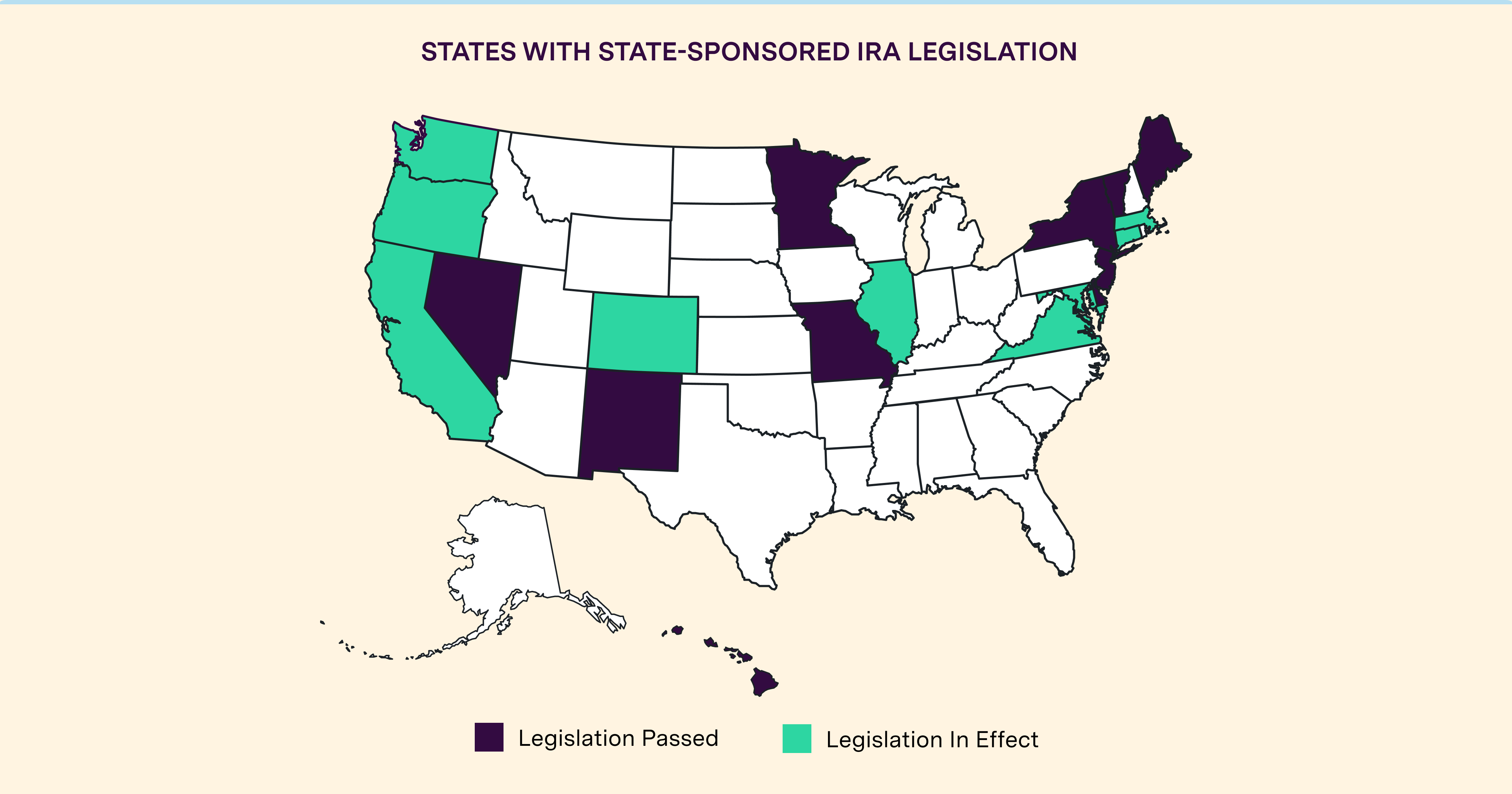

Nine states have active legislation and ten states have passed legislation that have yet to come into effect, though Maine is currently piloting the program with a few businesses. So far, states have seen positive results. According to the Georgetown Center for Retirement Initiatives, employees have saved more than $1 billion in state-sponsored retirement programs as of January 2023, much of which likely would not have otherwise been saved.

Benefits of state plans include:

While plans provide many positive benefits, experts point to several opportunities for improvement. Employees often find that the state plans are more rigid and don’t provide the flexibility for investment options that they enjoy with private plans. Additionally, employers operating across multiple states often find themselves mandated to participate in several programs, which complicates administration.

Also, when state plans were introduced, there was concern about the impact on private plans. But a 2023 Pew article reports that state-sponsored plans are actually positively affecting private plans. According to federal data, employers continue to launch retirement plans for their employees, even in states with sponsored programs. Additionally, the rate of employers terminating private plans is about the same as before state plans were offered.

Currently, nine states have state-sponsored retirement legislation with active plans, and in all of these states, eligible employees can contribute to their retirement through these plans.

As states are successfully implementing state-sponsored programs and seeing positive results of more employees saving for retirement, additional states are likely to propose legislation. Because details are currently evolving for many plans, employees and employers should verify all information in this guide.

Here are the details of the states with active plans as of October 2023:

The plan: CalSavers

Who is covered: California residents who do not have access to a work-sponsored plan can participate. The CalSavers plan only requires companies to have one California employee for eligibility.

The details: CalSavers sets up a Roth IRA for employees enrolled in the program. Because the program is opt-out, employees whose employers start the process automatically save 5% of their gross income unless they change the amount or opt-out.

Employers who do not have a work-sponsored plan and have more than one employee in California are required to participate. Fines are currently levied against companies with more than five California employees that do not participate, and those with at least one employee will be fined starting December 31, 2025, if not enrolled.

The plan: SecureSavings

Who is covered: Employees who work at companies that have been in business for at least two years, do not offer a private plan, and have at least five employees.

The details: SecureSavings sets up a Roth IRA for employees enrolled in the program. While the plan offers a Roth IRA for all employees enrolled in the plan, employers can also select to offer qualified retirement plans like a 401(k), which also meets the state requirements. Because many employees move between Colorado and New Mexico, the two states offer the first multi-state IRA program to improve savings and portability.

Because the program is opt-out, employees whose employers start the process automatically save 5% of their gross income unless they change the amount or opt-out.

The plan: My CTSavings

Who is covered: Employees who have worked for at least 120 days at a company that has at least five employees being paid at least $5,000 in taxable wages and does not offer a private plan.

The details: My CTSavings was one of the first to offer both Roth and traditional IRAs, with traditional IRAs set up for employees who do not pick a plan. They have 60 days to decide to opt in or out after the employer enrolls them in the plan. The plan automatically saves 3% of the employee’s pay, which the employee can increase or decrease throughout the year.

The plan: Illinois Secure Choice

Who is covered: Employees who work at a company with at least five employees.

The details: Illinois Secure Choice provides a Roth IRA, and employees who do not set an amount are enrolled at 5%. The funds are invested in an account based on the employee’s target retirement date, which helps mitigate risks for the employees.

Employees who do not qualify for a Roth IRA are offered a traditional IRA. Employees can increase or decrease the amount by up to 10%. Additionally, the program automatically increases the employee’s contribution annually.

The plan: MarylandSaves

Who is covered: Employees who work at a company with an automated payroll system that does not offer a private plan. Self-employed Maryland citizens can also set up their own accounts and contribute.

The details: MarylandSaves launched in 2022 and sets up an Auto IRA for eligible employees. When an employee begins investing, the first $1,000 of contributions is put into an emergency savings program that the employee can access. After the emergency account is funded, the investments go into a fund based on their target retirement date. Additionally, employers who sign up are given a waiver of $300 in state annual reporting fees.

The plan: CORE plan

Who is covered: Employees who work at a company with fewer than 20 employees who do not have access to a private plan. However, the employer must sign up to participate in the plan. Unlike other states, the Massachusetts plan is voluntary and does not fine companies that do not participate.

The details: The CORE plan invests savings into a 401(k) multiple employer plan (MEP). The initial contribution is set at 6% and can be adjusted by the employee. Employers can also offer matching contributions through the plan. Employers who participate in the CORE plan must pay an annual administrative fee.

The plan: OregonSaves

Who is covered: All companies, regardless of the number of employees.

The details: OregonSaves invests in a Roth IRA based on a target retirement date, with the initial contribution defaulting to 5%. Employees can also select a money market or S&P 500 investment option. Employees can adjust their contributions from 1% to 100% of their paycheck. For the first 30 days after enrollment, all investments go to fund the employee’s Capital Preservation Fund, which is in money market securities and gives the employee quick access to cash in an emergency.

The plan: RetirePath Virginia

Who is covered: Employees who work for companies that have been in operation for at least two years, do not offer a private plan, and employ at least 25 people. Employees must work at least 30 hours a week. Virginia residents who are self-employed and earn taxable Virginia income can also enroll.

The details: RetirePath Virginia was launched in the summer of 2023. The contributions default to a Roth IRA, but employees can change to a traditional IRA.

The plan: Retirement Marketplace

Who is covered: Participation is voluntary by employers and is open to all businesses not offering private plans.

The details: The Retirement Marketplace offers nine plans that employees can choose from. Instead of managing the plans like other states, the marketplace allows employees to find retirement plans and then manage their own enrollment.

| State | Current Legislation | Details | Status |

|---|---|---|---|

| Delaware | HB 205 | Available to employees at companies that have five or more employees, don’t offer a qualifying alternative retirement plan, and have operated at least six months in the preceding year. | Implementation planned for January 1, 2025 |

| Hawaii | SB3289 SD2 HD2 CD1 | Available to all private-sector employees who do not have access to employer-sponsored retirement plans. While most states automatically enroll employees and require them to opt-out if they don’t want it, employees in Hawaii must opt-in for the Hawaii Retirement Savings Program. Hawaii will match up to $500 in the accounts of the first 50,000 covered employees who participate in the program for 12 consecutive months after initial enrollment. |

TBD |

| Maine | LD 1622 | Maine Retirement Investment Trust provides retirement savings for employees at companies with more than 5 employees that do not have a company plan. The Maine and Colorado programs are partnering together to reduce costs. | Limited pilot program in progress. Fully active Winter 2024 |

| Minnesota | HF 782 | The board is still determining coverage and implementation details. | January 2025 |

| Missouri | SB1125 | Missouri Workplace Retirement Savings Plan provides a retirement plan for employees at companies with less than 50 employees. Participation will be voluntary by employers. | September 2024 |

| Nevada | SB 305 | The board is still determining coverage and implementation details. | TBD |

| New Jersey | New Jersey 8 Secure Choice Savings Program Act | New Jersey Secure Choice Savings Program will provide a retirement plan for employees at businesses with 25 or more NJ employees without a current employee retirement plan. | TBD |

| New Mexico | SB 129 | The New Mexico Work and Save Act will provide retirement programs for employees at all companies not offering private plans. However, participation is voluntary for employers. New Mexico partnered with Colorado to make it easier for residents moving between the states to continue retirement savings without interruption. | July 2024 |

| New York | Senate Bill S5395A | New York Secure Choice Savings Program will provide retirement programs for all employees of companies, regardless of size, that do not offer a private plan. | TBD |

| Vermont | S-135 | VTSaves will provide a retirement savings program for all employees at companies without a private plan with a phased rollout for mandated enrollment. The program starts by requiring companies with more than 50 employees that do not have access to a private plan to enroll and moves to companies with no private plan and at least five employees. The program replaces a previous MEP program with a Roth IRA. | July 2025 |

State-sponsored plans are a positive step forward to provide access to retirement savings for many Americans and will hopefully increase the number of Americans adequately saving for retirement.

But as the retirement saving world continues to evolve and fragment into different employer or state-sponsored plans, consolidation and rolling over from job to job is more important than ever. Retirement savings will likely become even more fragmented as more states add plans and more employers participate.

Capitalize is excited to continue shining a spotlight on efforts to improve retirement savings outcomes as we build technology to digitize the rollover process and help individuals proactively transfer their savings when they change jobs.