Save hours of your time by rolling over your 401(k) into an IRA you control - for free.

Get StartedWhen it comes to your retirement, preparation is everything. And individual retirement accounts — otherwise known as IRAs — are one of the very best ways to prepare to live out your golden years in peace and financial security.

These investment vehicles offer unique tax benefits that make them a great way to set yourself up for success in retirement. While there are many different types to choose from (some of which carry stricter eligibility criteria), traditional IRAs are available to anyone with earned income and their spouses, whether or not they work.

Below, we’ll walk you through all things IRA, starting with the basics. We’ll explain the meaning of tax-deferred growth, as well as some advanced techniques for making the most of IRA tax breaks. We’ll help you figure out how to maximize your contributions, determine whether you’ll need to take required minimum distributions (RMDs), and learn more about rollovers. You’ll learn to make the most of your IRA and use it in your favor as the powerful retirement tool it can be.

An IRA is a tax-advantaged investment account that allows you to save and grow retirement funds with special benefits. For example, traditional IRAs offer a potential tax deduction in the year you make your pretax contributions, while Roth IRAs promise income-tax-free withdrawals in retirement so long as you follow certain rules.

IRAs are especially important for independent contractors and others who work for themselves and may not have access to an employer-sponsored retirement account, like a 401(k). Note that even if you have access to an employer-sponsored retirement account, you can contribute to an IRA, but your contributions may not be tax-deductible, depending on your income.

Since you don’t need your employer to access an IRA, how do you get one? Fortunately, it’s pretty easy: Many banks, financial firms, and online brokerages provide investment accounts designed for retirement like IRAs.

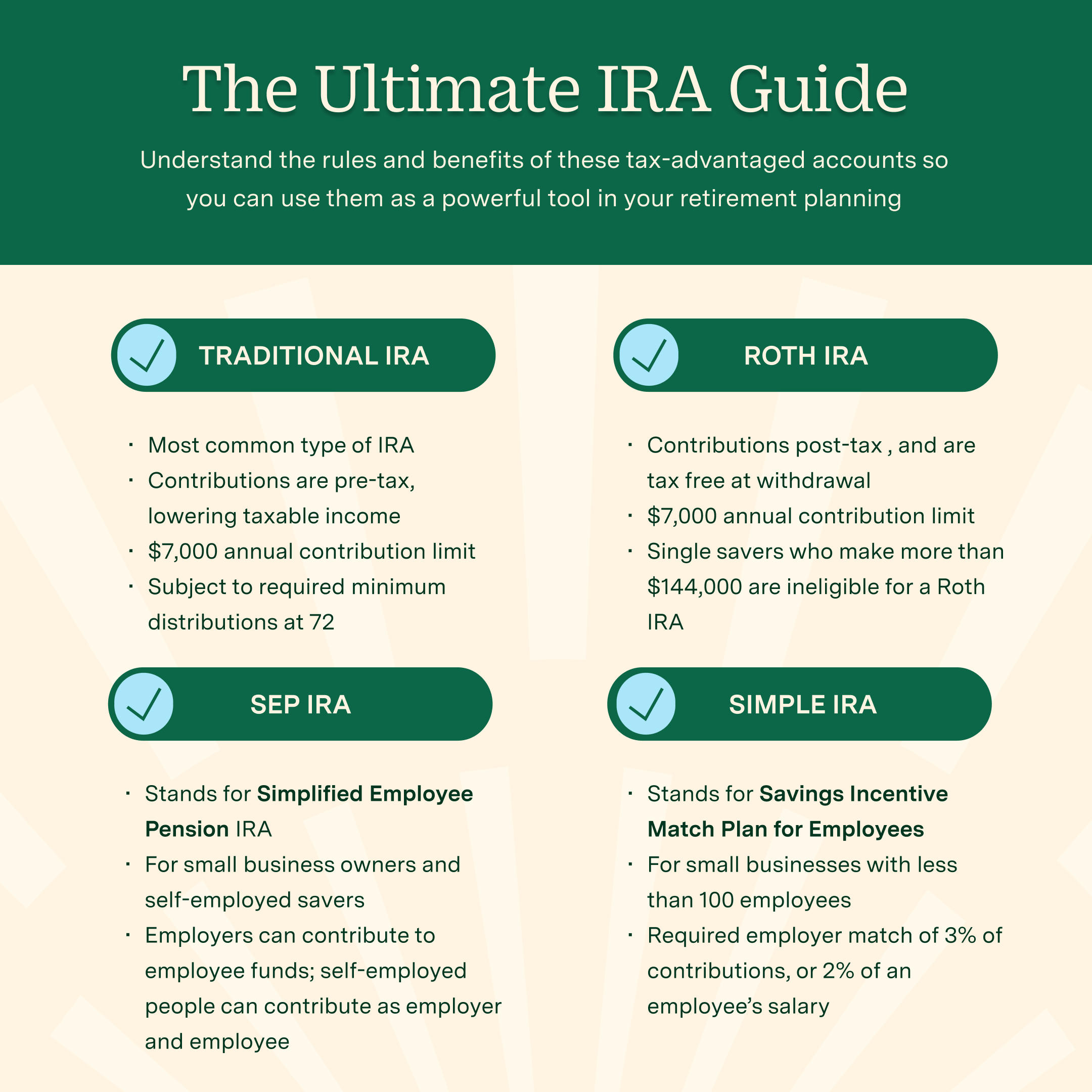

That said, there are several different types of IRAs to choose from, each with its own unique set of rules and benefits.

Even the best-intended retirement planning will fail if you don’t follow the rules. Here’s what you need to know about the various types of IRAs your financial institution may offer, along with their eligibility requirements, contribution limits, and how they can affect your taxes.

Traditional IRAs are a common type of IRA with a familiar tax structure you might recognize from other retirement accounts like 401(k)s.

In short, you put money into your traditional IRA before paying taxes on it, which means those contributions may lower your taxable income in the year you make them. The money then grows tax-free until you reach retirement, at which point your withdrawals are taxed as regular income.

Because it’s taxed at withdrawal, traditional IRAs may be the preferred method if you expect to be in a lower income tax bracket later in your life than you are today. Traditional IRAs can also be a good choice for high earners since Roth IRAs have income-based eligibility restrictions that we’ll discuss in a moment.

Plus, tax-deductible contributions get you a tax break in the year they’re made. However, if you or your spouse have access to an employer-sponsored plan, your traditional IRA contributions may not actually be deductible depending on your income. It’s always a good idea to check the latest guidelines from the IRS.

Traditional IRAs, like all retirement accounts, have annual contribution limits. These limits tend to change each year. The IRA contribution limit applies to both traditional and Roth IRAs. In other words, you can have both a traditional and a Roth IRA, but you can only contribute up to the limit across both accounts.

For 2024, the IRA contribution limit is $7,000 if you’re younger than 50, up from $6,500 in 2023. The IRS also allows savers 50 and older to invest extra funds, known as catch-up contributions. If you’re 50 or older, you can invest an additional $1,000, bringing your total contribution to $8,000 in 2024 ($7,500 in 2023).

Traditional IRAs are also subject to required minimum distributions, or RMDs. These are withdrawals you’re obligated to take once you reach age 73. If you fail to take RMDs, you could face a penalty of up to 25% of the required distribution.

Likewise, if you take money out of your traditional IRA before age 59½, you’ll likely face a 10% early withdrawal penalty. There are a few exceptions, though, such as if you’re making what the IRS considers a first-time home purchase.

Roth IRAs are basically the inverse of traditional IRAs: Roth IRA contributions are made with after-tax dollars, which means you don’t get a tax break upfront. But your withdrawals during retirement are tax-free under most circumstances.

That makes Roth IRAs an especially helpful tool for those who expect to be in a higher tax bracket come retirement time. They also tend to be a good choice if you want to spread out your taxes across your lifetime and pay some taxes today to avoid some taxes later.

Unlike traditional IRAs, they are not subject to RMDs during your lifetime if you’re the original account holder. This makes Roth IRAs an especially attractive option if you want to pass down a tax-free inheritance to your heirs after you die.

Roth IRAs have the same annual contribution limits as traditional IRAs. But given their potential tax-free growth, it’s not surprising that Roth IRAs come with a few extra rules.

For starters, Roth IRAs have the following income limits in 2024:

To make the full contribution, you must earn less than:

To make a partial contribution, you must earn less than:

If you earn more than these income thresholds, you’re not allowed to directly fund a Roth IRA. There are some ways around this, though, such as a backdoor Roth IRA strategy.

Additionally, Roth IRAs are subject to what’s known as the five-year rule, which is actually a set of five-year rules with some subtle distinctions. The short version, though, is that your Roth IRA must have been open for at least five years to make tax-free withdrawals of earnings, even if you’ve met the other requirements, like reaching age 59 1/2. If you ignore the five-year rule, you may owe income taxes on withdrawals. However, you can always withdraw Roth IRA contributions without owing taxes or a penalty.

The simplified employee pension (SEP) IRA is not as well-known as traditional and Roth IRAs. But for small business owners and self-employed individuals, they can be a game-changer.

SEP IRAs allow independent contractors and small business owners to maximize their retirement savings by making contributions as both the employer and employee. For example, if you’re a small business owner, you can put money into your own SEP IRA, as well as the accounts of employees, including yourself. If you’re an independent contractor, you can put money into your SEP IRA as both employee and employer. However, if you’re employed by a company that offers a SEP IRA, you can’t make contributions on your own behalf.

SEP IRA contribution limits are substantially higher than other IRA annual contribution limits: In 2024, employers may contribute 25% of an employee’s compensation, up to a maximum of $69,000 ($66,000 in 2023). Furthermore, SEP IRA contributions are tax-deductible.

If you’re a small business owner with multiple employees, though, take heed: IRS rules require you to contribute the same percentage of compensation for each qualified worker. Basically, if you contribute 10% of your salary to your own SEP IRA, you’ll also need to contribute 10% of each eligible employee’s salary.

A worker is generally considered an eligible SEP IRA participant if:

Another option for self-employed people and those who run their own companies is the Savings Incentive Match Plan for Employees (SIMPLE) IRA. SIMPLE IRAs are only available to companies with 100 employees or fewer.

With a SIMPLE IRA, employers are required to contribute to employees’ retirement accounts. Employers can either:

One of the best things about the SIMPLE IRA is that it’s easy to manage and requires little paperwork compared to other employer-sponsored retirement plans.

However, SIMPLE IRAs also have a potentially pricy quirk: Withdrawals taken within two years of the account opening are subject to an early withdrawal penalty of 25% rather than the typical 10%. The 25% penalty also applies if you roll your SIMPLE IRA into a retirement plan other than a SIMPLE IRA within the first two years.

Still, a SIMPLE IRA can offer workers an incentive to save for retirement, while making it easier for small business owners to offer a retirement plan.

Choosing the right type of IRA is an important first step — but once you’ve opened and funded your account, you still have to choose what to invest in.

At most brokerages, IRA holders can choose from a sweeping range of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). You might also choose to work with robo-advisors, which can help you manage your investment accounts using computer algorithms.

Everyone’s risk tolerance is different, and all investments come with risk. Though SIPC insurance can protect you in the rare event that your brokerage firm fails, it doesn’t safeguard you from investment losses.

Diversifying your portfolio is one of the most important steps for minimizing your risk. The old saying is true: It’s foolish to put all your eggs in one basket. In addition to choosing investments from different companies, consider spreading your investments across different asset classes and industries.

As your financial goals and market conditions change, be sure to check in on how your IRA investments are allocated and change them as needed. A financial advisor can be a trusted advocate and guide in this regard.

Capitalize will manage the entire rollover process for you - from finding your 401(k) to transferring the funds into an IRA of your choice.

Setting up an IRA from scratch is a good first step, and it’s fairly straightforward. But IRA rollovers and transfers are another important tool in your arsenal for managing your retirement savings.

For example, if you have an old 401(k) from a previous job or you’re considering taking the leap from your salaried career into full-time freelance work, moving your employer-sponsored retirement plans into a rollover IRA can help you maintain control over those funds. Making informed investment choices is the best way to ensure those accounts keep growing over time. Consolidating all your retirement savings accounts into one place can also make things easier when it’s time to take those penalty-free withdrawals in retirement.

When choosing an IRA provider, consider the fees, investment options, customer service, and other account features to ensure it fits your financial goals and preferences. Capitalize can help you compare IRA providers side-by-side to make this step easier.

Keep in mind that there are some important IRA rollover rules that could lead to big surprises when you file your tax return if you’re not careful. A direct rollover, also known as a trustee-to-trustee rollover, is commonly recommended instead of an indirect rollover to avoid unexpected taxes.

Roll over to an IRA of your choice in minutes.

Capitalize is an online service that helps you digitally locate your old 401(k) and pairs you with an expert who manages the entire process of rolling over your 401(k) into a Roth IRA of your choice for you – for free. This can save you hours of your time and spare you the headache of going through the antiquated rollover process. Capitalize is a great option for you if you’re busy or unsure about how to approach the 403(b) rollover process yourself.

Here are answers to some of the most commonly asked questions about individual retirement accounts.

Ideally, yes! IRAs are tax-incentivized retirement plans designed to help you grow your money over time.

The funds grow because they are invested primarily in the stock market — which, of course, means there’s some risk involved. But even with major setbacks like the Great Depression and the 2008 housing crash, the stock market has historically trended upward over long periods of time.

Roth IRA contributions are never tax-deductible. You can deduct or write off your full traditional IRA contribution if neither you or your spouse has access to an employer-sponsored account, regardless of income.

But if you or your spouse is covered by a workplace account, income limits determine how much of your traditional IRA contribution you can deduct. Income thresholds change from year to year, so check with the latest IRS guidelines.

The answer is yes, but in most cases, you should think twice before doing so. Early withdrawals are often subject to a 10% early withdrawal penalty and income taxes. Your money will also have less time to compound and grow.

The rollover time limit is 60 days in order to avoid paying the early withdrawal penalty on the funds you’ve rolled over. This is especially important for those making indirect rollovers since they’ll need to deposit the check to the new account themselves. Making a direct or trustee-to-trustee rollover, in which the funds are never withdrawn in your name, can help you avoid paying any penalties or taxes during the process.

Although the specific benefits depend on which type of IRA you have, the main benefit of any individual retirement account is that you get a tax break when you invest for retirement. For traditional IRAs, one of the best benefits is the potential tax deduction, while Roth IRAs carry the attractive incentive of tax-free withdrawals during retirement.

Anyone with earned income can contribute to a traditional IRA, but if you or your spouse has access to an employer-sponsored retirement plan, the amount of your contribution that is deductible may be reduced.

To be eligible to contribute the full annual limit directly to a Roth IRA, you must make less than $146,000 as a single person or $230,000 as a married couple filing jointly in 2024.

IRAs are one of the best tools to save for a secure financial future in retirement. That’s especially true when you have a better understanding of how they work.

Still, retirement can be a confusing topic, and the IRS has a tendency to change things around on the regular. If you’re still confused about your investment options, have questions about IRA rollovers, or are hoping to get the most out of all your retirement options, Capitalize is here to help. We make finding your old 401(k) a breeze—and save hours of your time by rolling it over seamlessly into an IRA of your choice. That way, you have full control over all of your retirement funds—which means full control over your future.